History

The LISI

Group

A history of sustainable links

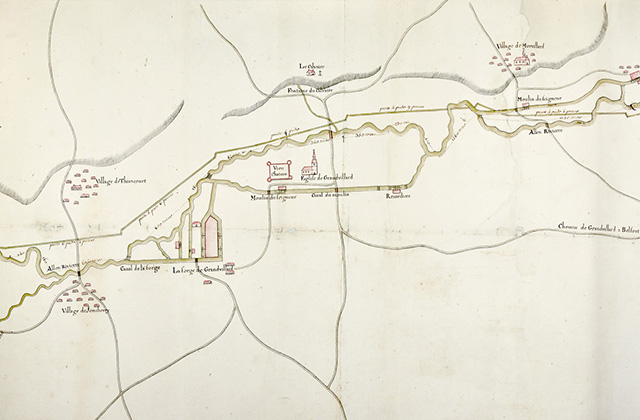

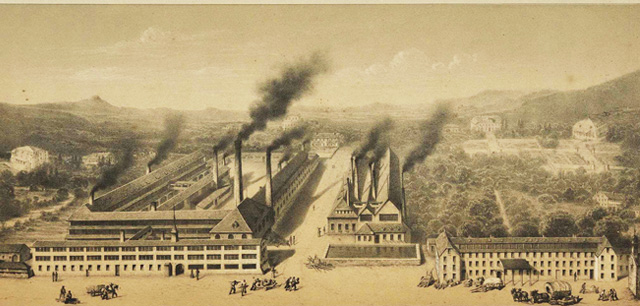

Founded in 1777 in Beaucourt by Frederic Japy, LISI was originally a small watchmaking factory located in an industrial area.

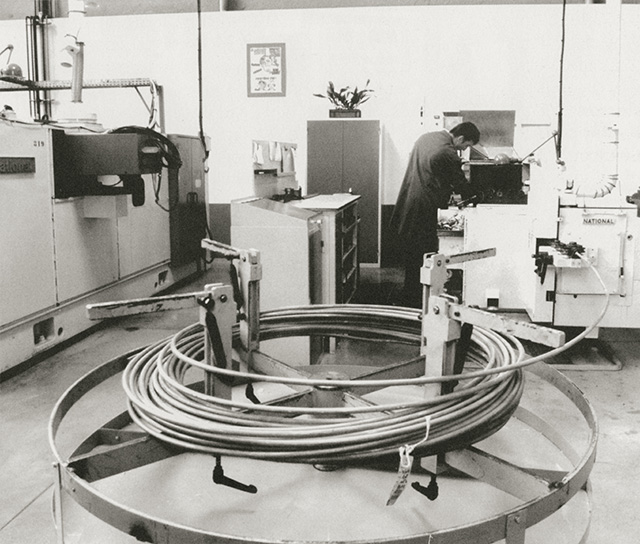

By integrating its know-how in steel wire working, the Group laid the foundations of its model and developed first in the automotive sector, which would become one of its main growth drivers.

In the 1960s, after the successful merger of family companies associated from the beginning, the company became the French leader in automotive screws and bolts. In 1977, the Group took a strategic turn by entering the aerospace sector and consolidating its expertise in the production of increasingly complex fastening systems. This increasingly strong position has enabled LISI AEROSPACE to become one of the three world leaders in the sector, recognized for its technological expertise, production control and industrial performance.

In the 2000s, in order to assert its international stature, the Group adopted the name LISI, marking a new stage in its strategy of global growth.

Building on this dynamic, LISI continued its diversification in the automotive sector with the acquisition of the American company Termax in 2018, strengthening its expertise and innovation capacity in the market for clip-on fasteners for the automotive industry. In 2025, LISI AUTOMOTIVE consolidated its presence in Central Europe with the acquisition of POLYSEMBLE HUNGARY in Györ, thereby expanding its range of assembly solutions.

At the same time, the Group created the LISI MEDICAL division in 2007, specializing in reconstructive surgery. However, in 2025, LISI underwent a strategic refocusing by selling this division in order to concentrate on its two core high value-added activities: aerospace and automotive.

Today, LISI continues its history by consolidating its global leadership in aerospace and automotive. True to the spirit of innovation and operational excellence that has shaped its identity since 1777, the Group is resolutely looking to the future with a focus on sustainable growth.

Our history in detail

Consolidation of the strategy around aerospace and automotive

• On September 30, LISI AUTOMOTIVE acquired POLYSEMBLE HUNGARY in Győr to strengthen its range of assembly solutions in Central Europe.

• On October 31, LISI sold LISI MEDICAL to SK CAPITAL while retaining a minority stake. The Group is ambitiously positioning itself to support the development of its two strategic activities: aerospace and automotive.

Expansion driven by performance

• LISI MEDICAL grows in the United States with the expansion of its Big Lake site in Minnesota.

• LISI AEROSPACE inaugurates a new building in Saint-Ouen-l'Aumône.

The Group is pursuing its objectives and keeping on course!

• Creation of LISI GLOBAL SERVICES, the Shared Services Center (SSC) for accounting in France.

• Creation of a CSR Department - Corporate Social Responsibility.

• Launch of our purpose: "Shape and share sustainable links".

Strengthening of the Group’s strategic activities

The LISI Group continued its adaptation plan initiated at the start of the health crisis and strengthened its strategic positioning on high value-added activities:

• Disposal of the subsidiary LISI MEDICAL Jeropa (United States) to reposition itself in its core business.

• Disposal of the LACE subsidiary (LISI AEROSPACE).

• Acquisition of the American company B&E Manufacturing by LISI AEROSPACE to extend the product offer on the high-precision hydraulic fittings market.

Refocusing activities on high added value solutions

The Group is refocusing its activities on fastening solutions and high added value components.

• LISI AEROSPACE sells two non-strategic subsidiaries: Indraero-Siren in France and LISI AEROSPACE Creuzet Maroc.

• LISI AUTOMOTIVE sells its chassis screws, chassis studs and ball joints (St-Florent site) and its German subsidiary LISI AUTOMOTIVE Mohr Friedrich GmbH specializing in hot forging and producing in particular for the truck market.

LISI becomes the owner of 100% of the capital of the American company Termax.

LISI AUTOMOTIVE expands in the United States

With the acquisition of the American companies Termax and Hi-Vol Products, LISI AUTOMOTIVE considerably bolsters its clipped fasteners and high added-value mechanical safety components business and takes on an a global dimension: the division is now present in the 3 major regions for the production of automobiles: China, Europe and North America.

LISI MEDICAL acquires a new business

The acquisition of Remmele Medical Operations enables the medical division to expand its industrial operations in the United States and position itself in a new and very promising segment: the manufacture of minimally invasive surgical instruments.

LISI AEROSPACE started expanding in structural components

With the takeover of Creuzet Aéronautique in 2011, followed by that of Manoir Aerospace in 2014, LISI AEROSPACE started expanding in “complex structural components”, complementary to the fasteners. Such diversification was for LISI AEROSPACE a means to acquire a new dimension in customer relations and establish itself among the major aerospace equipment manufacturers.

A new division was created, LISI MEDICAL

Between 2007 and 2010, LISI acquired four companies that manufactured dental implants or assembly systems (screws, pins) used in reconstructive surgery. In 2010, with the takeover of Stryker Corporation's hip prosthesis production site located in Hérouville-Saint-Clair, in Normandy, the group set up a new division, LISI MEDICAL.

The group was renamed LISI

In 2000, the group acquired Rapid, which manufactured clips for automobiles. The manufacturing technologies differ between screws and clips, but the commercial approach and the profession are identical. The group harnesses the complementarity of products to stand out from its competitors and position itself as one of the only multi-specialist players in fasteners. It eventually did the same in aerospace with the 2003 acquisition of the Californian Monadnock.

To better mark this positioning, the group took the name LISI in 2002: “Link Solutions for Industry”.

Development through strong external growth

After being floated on the Second Marché of the Paris Stock Exchange in 1989, the group strengthened itself over the following decade by acquiring more than fifteen companies in Europe and the United States.

The aerospace business kicked off

In the 1970s, GFD acquired two aerospace subcontracting companies, thanks to the support, of Blanc Aero Industries (BAI), a company specializing in aerospace fasteners. In 1977, GFD and BAI decided to merge to form Générale Financière et Industrielle (GFI). The operation was made possible thanks to an equity investment by the Peugeot family. Even today, the Kohler, Peugeot and Viellard families remain the major shareholders of LISI.

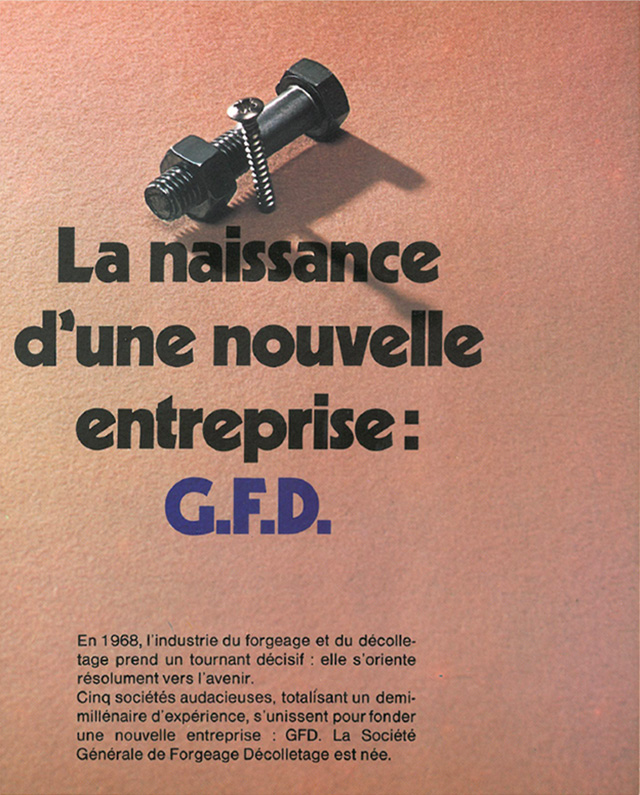

Towards the creation of an industrial group: GFD

The family-run businesses Bohly, Dubail-Kohler and Viellard merged into Générale de Forgeage Décolletage (GFD). The new group became the leading French manufacturer of standard and automotive screws and bolts.

Japy's screws and bolts business was taken over by SID, Bohly Frères and VMC

The Société Industrielle de Delle (SID) was founded by the Dubail brothers, Joseph Kohler and Joseph Frossard

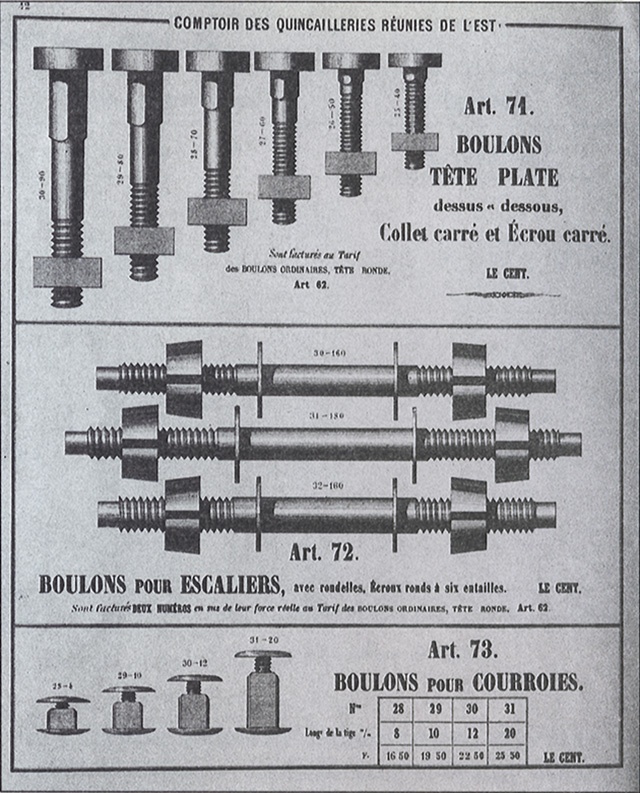

Comptoir des quincailleries réunies de l’Est was created, with branches in Paris, Barcelona, Milan, Zürich, Stuttgart and Buenos-Aires

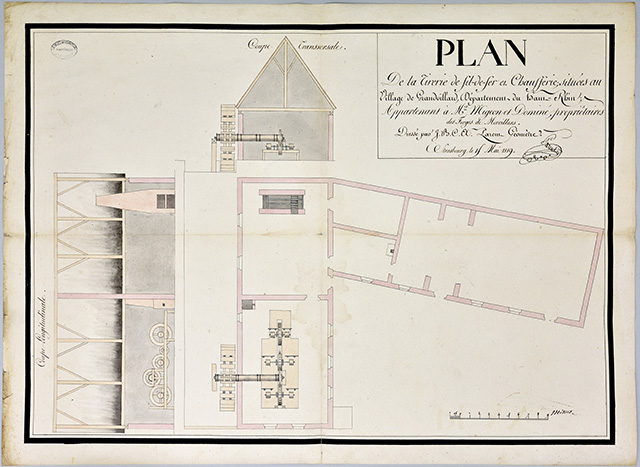

Juvénal Viellard joined Migeon & Dominé, which was eventually renamed Viellard-Migeon & Compagnie (VMC)

First industrial manufacture of forged wood screws by Japy-Frères and Migeon & Dominé

Foundation of the Migeon & Dominé factory initially specializing in the production of wire

1777

1777

Frédéric Japy created a watchmaking factory in Beaucourt