LISI 2012 FINANCIAL REPORT

87

4

COMPANY FINANCIAL STATEMENTS

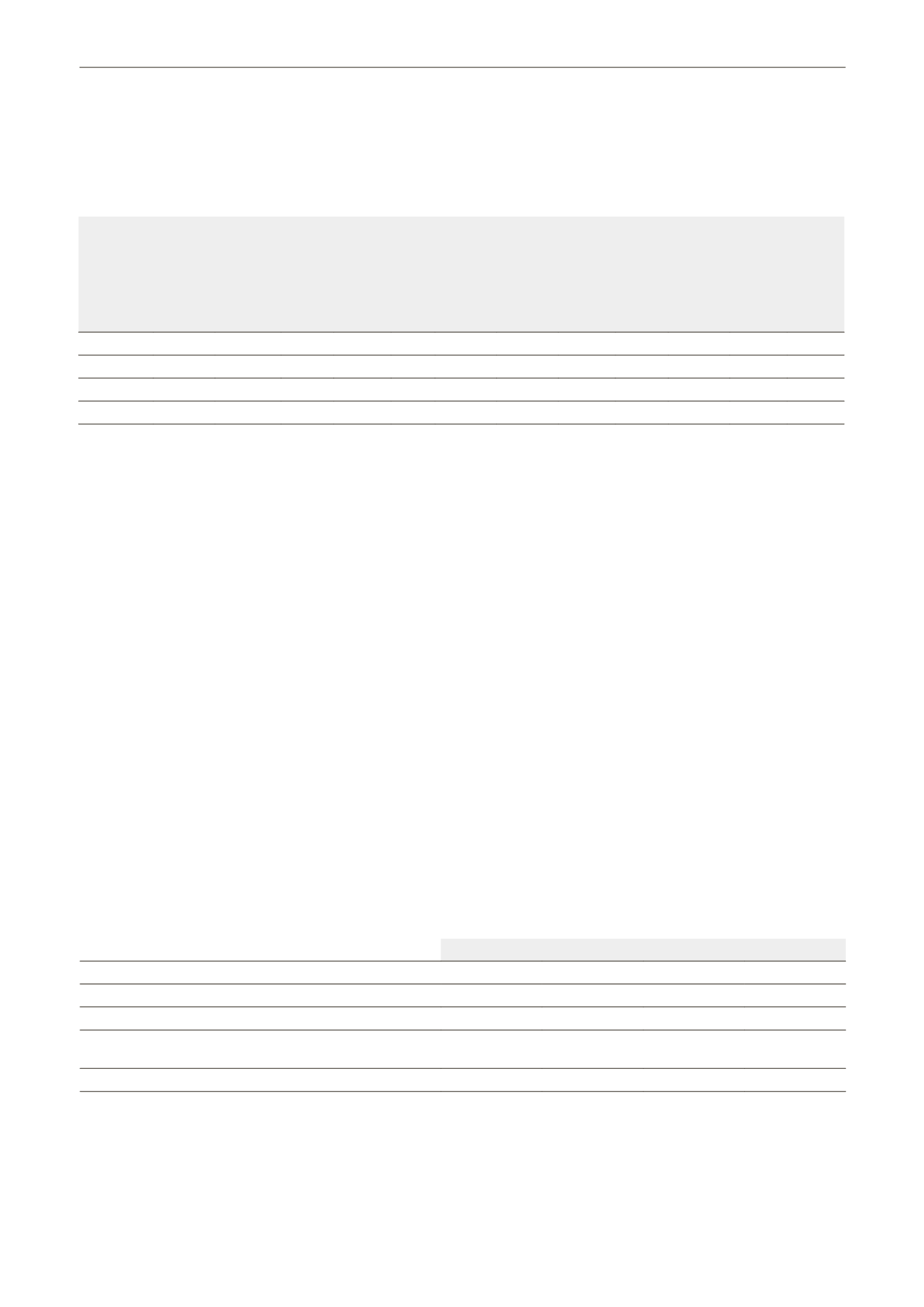

3.5.2 Subsidiaries and holdings (company data in €)

Companies

Share capital

Shareholders'

equity

and

minority

interests

Share

of capital

held

(in %)

Gross value

of the

securities

held

Provisions

on the

securities

held

Net value

of the

securities

held

Loans, advances

granted

by the company

not yet

repaid

Loans,

advances

received

by the

company

not yet

repaid

Amount of

guarantees

and

sureties given

by the

company

Sales revenue

excl. tax

for the last

financial year

Net Income

or net loss

for the last

financial year

Dividends

cashed by the

parent

company

during the last

financial year

Subsidiaries:

LISI AUTOMOTIVE 31,690,000 106,863,032 100,00% 93,636,481

93,636,481 34,115,317

26,919,458 (2,548,890)

2,002,808

LISI AEROSPACE

2,475,200 50,332,055 100,00% 30,863,816

30,863,816 6,685,934

216,808,115 9,929,029 11,000,000

LISI MEDICAL

33,337,000 29,771,035 100,00% 33,337,000

33,337,000 27,521,103

1,570,867 (450,821)

3.6 Identity of the consolidating

company

Compagnie Industrielle de Delle (CID)

Limited company with share capital of €3,189,900

Head Office: 28 Faubourg de Belfort – BP 19 – 90101 DELLE

Cedex

Compagnie Industrielle de Delle held 54.96% of the capital of

LISI S.A. as at December 31, 2012.

3.7 Allocation of performance shares

Acting on the recommendation of the Compensation

Committee, LISI's Board of Directors decided, on July 28, 2010,

to allocate performance shares to members of the Executive

Committee and to members of the principle Management

Committees for the three LISI Group divisions, subject to their

meeting certain performance targets: the achievement of

these two criteria at the end of 2011, namely EBIT and sales

revenue, resulted in the completion of 85% of that plan in 2012.

The final cost was allocated to the divisions.

Acting on the recommendation of the Compensation

Committee, LISI's Board of Directors decided, on June 26, 2011,

to allocate performance shares to members of the Executive

Committee and to members of the main Management

Committees for the three LISI Group divisions, subject to their

meeting certain performance targets. The same went in 2012,

insofar as the Board of Directors of October 24, 2012 renewed

the opening of a new plan under similar conditions.

The fair value of the benefits granted is recognized as a

provision in 2012 for an amount of €0.5m for the employees of

the French companies. This cost was not allocated to divisions,

and remains an expense at the LISI S.A. level until the definitive

realization of the plan. The impact of the expense relating

to the awards of free performance shares is included in the

payroll expenses. for employees of LISI S.A. only.

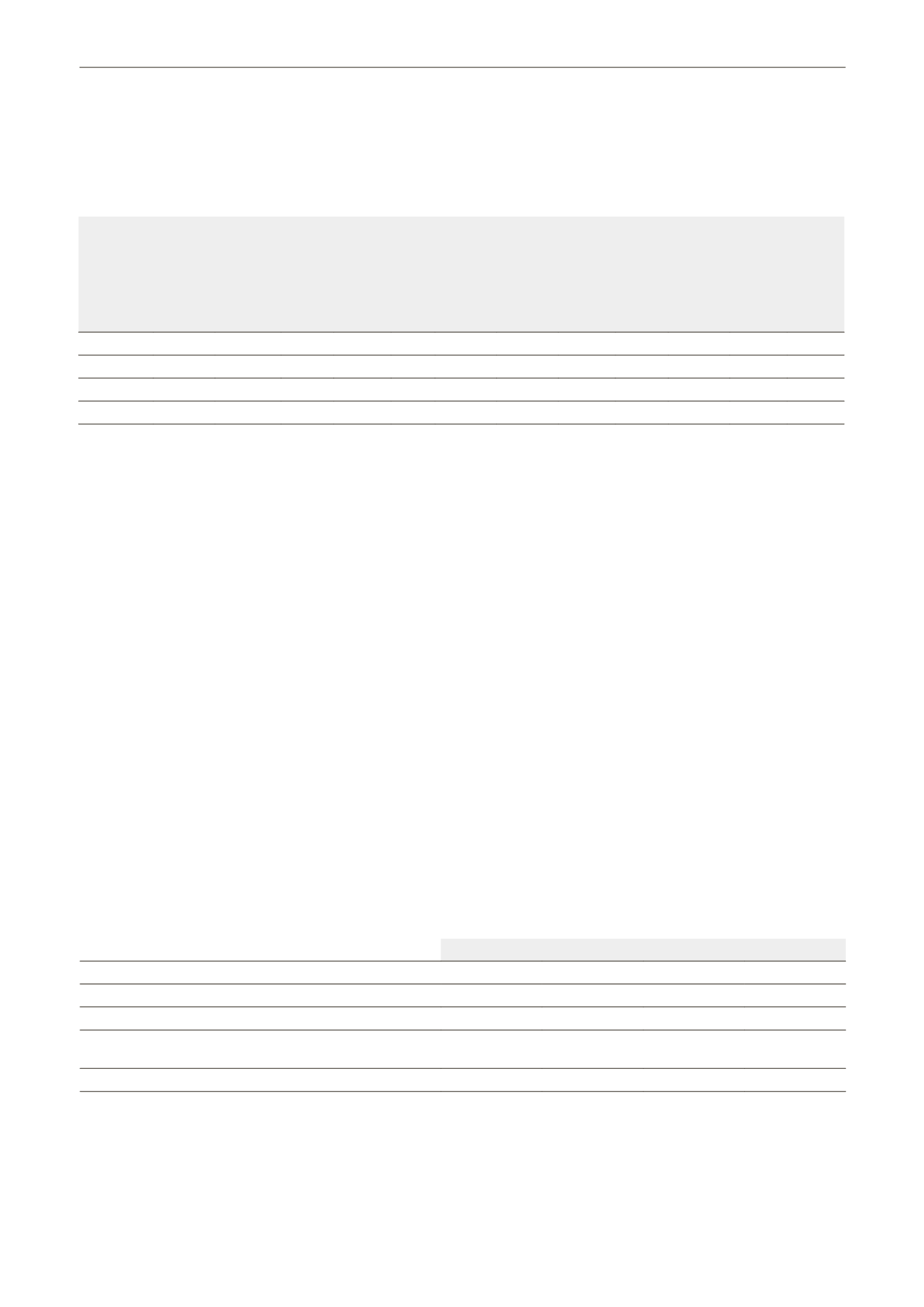

Plans that impacted LISI S.A.'s accounts in 2012:

Plan for 2010 Plan for 2011 Plan for 2012

Total

Allocation date

07/28/10

07/28/11 10/24/12

Acquisition date

10/24/12 February-14 February-15

Value in €'000 as at 12/31/2012

1,761

279

71

Impact in €'000 on the company's financial statements at

12/31/2012 (not including social security contributions)

175

279

71

524

Number of shares awarded

47,185

44,200

52,650