LISI 2012 FINANCIAL REPORT

85

4

COMPANY FINANCIAL STATEMENTS

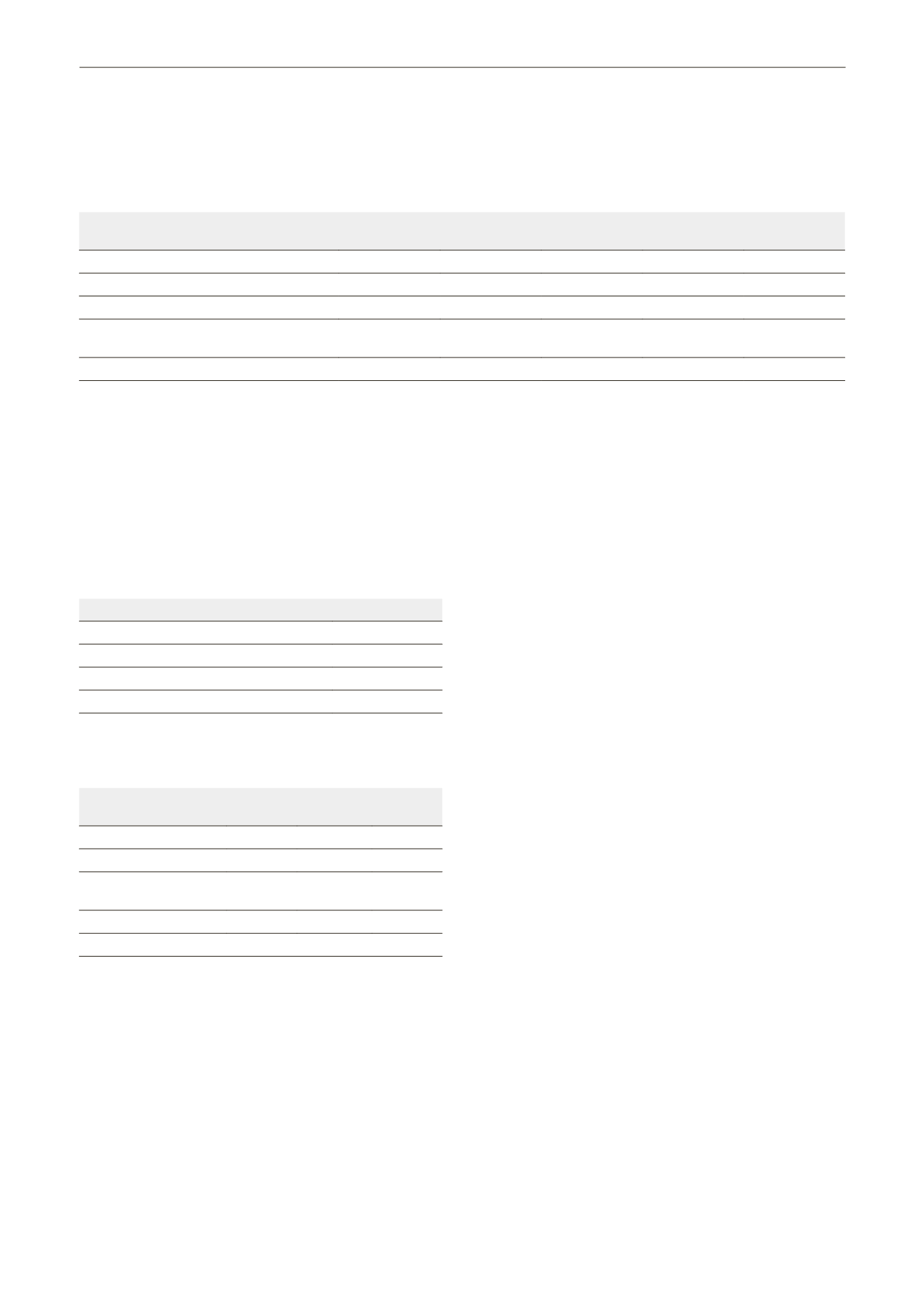

3.2.6 Provisions for risks and charges

(In €'000)

Amount

at year start

Provisions

Reversals

used

Reversals

unused

Amount

at year end

Provision for environmental risks

807

(807)

Provision for long service medals

5

1

6

Provisions for charges

450

150

(226)

374

Provision for stock options and the allocation

of free shares

1,175

349

(1,041)

483

Total

2,439

500

(1,267)

(807)

864

Provisions for charges mainly cover the setting up of a project

designed to reduce the number of accidents at work.

3.3

Detail of main income statement

items

3.3.1 Financial income from investments

(In €'000)

Amounts

Dividends received from subsidiaries

13,003

Dividends received outside the group

-

Interest from loans to subsidiaries

2,049

Total

15,052

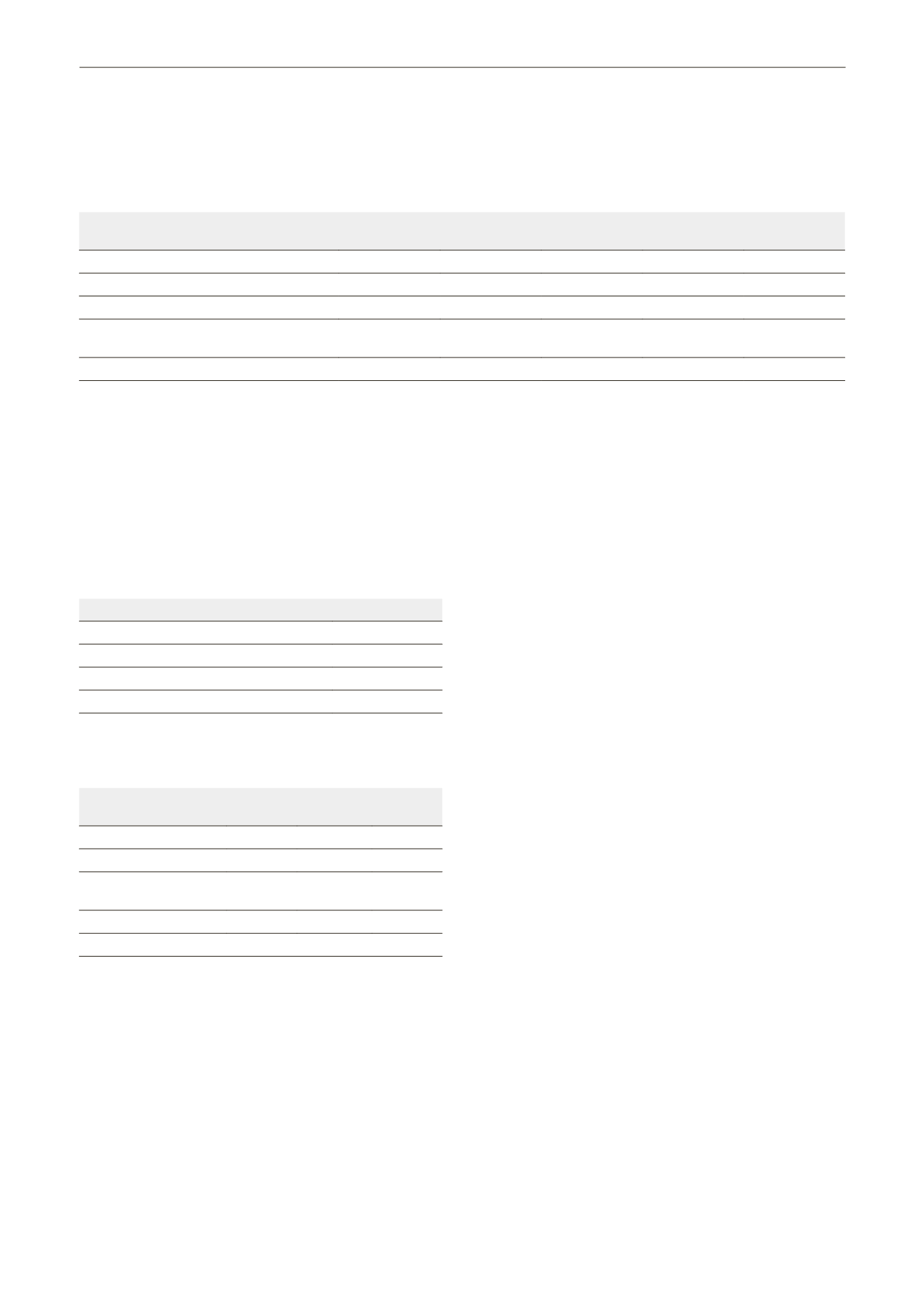

3.3.2 Breakdown of corporation tax

(In €'000)

Profit (loss)

current

Profit (loss)

non-recurring

Profit (loss)

Pre-tax earnings

15,714

(138)

15,576

Income tax

(617)

46

(571)

Tax credits, IFA &

miscellaneous

4

4

Tax integration taxes

2,135

2,135

Net earnings

17,236

(92)

17,144

The LISI Group benefits from the tax integration regime, which

covers all its French subsidiaries. The tax integration agreement

stipulates that tax gains should be retained at the parent

company level. The overall amount of corporate income tax at

December 31, 2012 is a tax income.

3.4 Financial commitments

Financial guarantees given:

LISI S.A. has signed letters of intent with banks relating to

the commitments made by some of the Group’s subsidiaries.

Moreover, its agreements with some partners require

compliance with financial covenants.

Commitments given under the terms of the transaction for the

divestiture of LISI COSMETICS.

Commitment for compensation granted in favor of the buyer

concerning any reassessments from the tax or environmental

authorities during a period of two years with effect from

the date of divestiture, subject to a deductible of €500k, to

exceeding a minimum threshold of €35k and to an upper limit

of €6m.

Financial derivatives:

LISI S.A. uses derivative financial instruments to hedge its

exposure to foreign exchange risk, and occasionally to hedge

its interest rate risks resulting from its financial activities. In

accordance with its cash management policy, LISI S.A. neither

holds nor issues derivatives for trading purposes.

The currency hedges are underwritten by LISI S.A. to cover all of

the LISI Group's needs.