LISI 2012 FINANCIAL REPORT

75

4

COMPANY FINANCIAL STATEMENTS

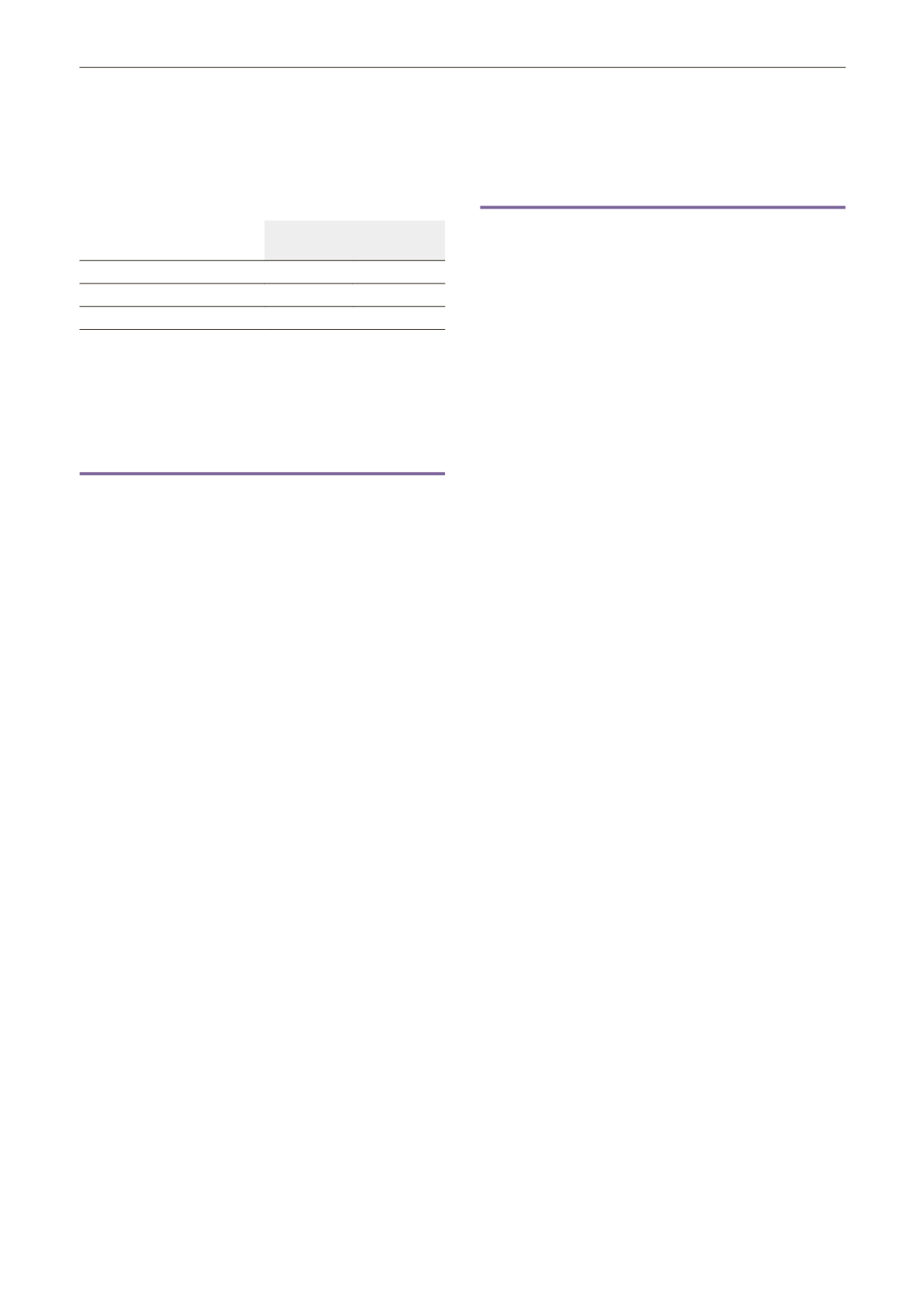

We also note that the dividend payouts per share, in euros,

were as follows:

Nominal value

of the share

Dividend

per share

Financial year ended 12/31/09

€2.00

€0.70

Financial year ended 12/31/10

€2.00

€1.05

Financial year ended 12/31/11

€2.00

€1.30

Please note that dividends are paid out 9 months after year

end, and the time limit after which dividend entitlement lapses

is 5 years, effective from the date when dividends were agreed.

Outlook for 2013

Upstream dividend payments from our various subsidiaries

and the maintenance of Group royalties should allow LISI S.A.

to continue its policy of supporting its divisions and to ensure

dividend increases for its shareholders.

Additional information

•

Deductible expenses for tax purposes are made up of

depreciation and hire of passenger vehicles and loan

payments totaling €16,629.

•

LISI S.A. has, through a market making agreement with an

independent service provider, purchased 121,223 LISI shares

for €6.6m and has sold 137,862 shares for a sum of €7.5m. At

December 31, 2012, the number of shares held through the

market-making agreement was 12,541.

•

Treasury stocks held at December 31, 2012 totaled 314,980

shares, including those related to themarket-making contract.

•

Trade payables excluding bills receivable amounted to €260k,

90% of which are settled immediately.

•

LISI SA bought, as at November 9, 2012, LISI MEDICAL shares

from LISI AEROSPACE at their net book value, or €33,337,000.

The number of securities held is 3,333,700.