LISI 2012 FINANCIAL REPORT

67

3

Consolidated financial statements

during a period of two years with effect from the date of

divestiture, subject to a deductible of €500k, to exceeding a

minimum threshold of €35k and to an upper limit of €6m€.

2.7.4.4 OTHER COMMITMENTS

No other commitment has been given or received.

2.8 EXCHANGE RATES OF CURRENCIES USED BY FOREIGN SUBSIDIARIES

2012

2011

Year end rate

Average rate

Year end rate

Average rate

US dollar

USD

1.3194

1.2932

1.2939

1.4000

Sterling

GBP

0.8161

0.8119

0.8353

0.8713

Yuan

CNY

8.2207

8.1451

8.1588

9.0301

Canadian dollar

CAD

1.3137

1.2906

1.3215

1.3805

Zloty

PLN

4.0740

4.1677

4.4580

4.1380

Czech crown

CZK

25.1510

25.1395

25.7870

24.5996

Moroccan Dirham

MAD

11.1604

11.1154

11.1351

11.2780

Indian rupee

INR

72.5600

69.0200

68.7130

65.5584

Hong Kong Dollar

HKD

10.2260

10.0296

10.0510

10.8960

2.9 POST-YEAR END EVENTS: INFORMATION

ON TRENDS

After the deconsolidation of KUT (Herscheid – Germany) sold

in May 2012, the reorganization of the LISI AUTOMOTIVE

Division should continue in 2013 with the combination of sites

in the "nuts" business. An initial briefing and consultation of

the Central Works Council of LISI AUTOMOTIVE Former was

held February 13, 2013. Management presented there the plan

to gradually consolidate the production of nuts on a limited

number of sites, which would eventually imply the shutdown

of the Thiant (Nord) site (59).

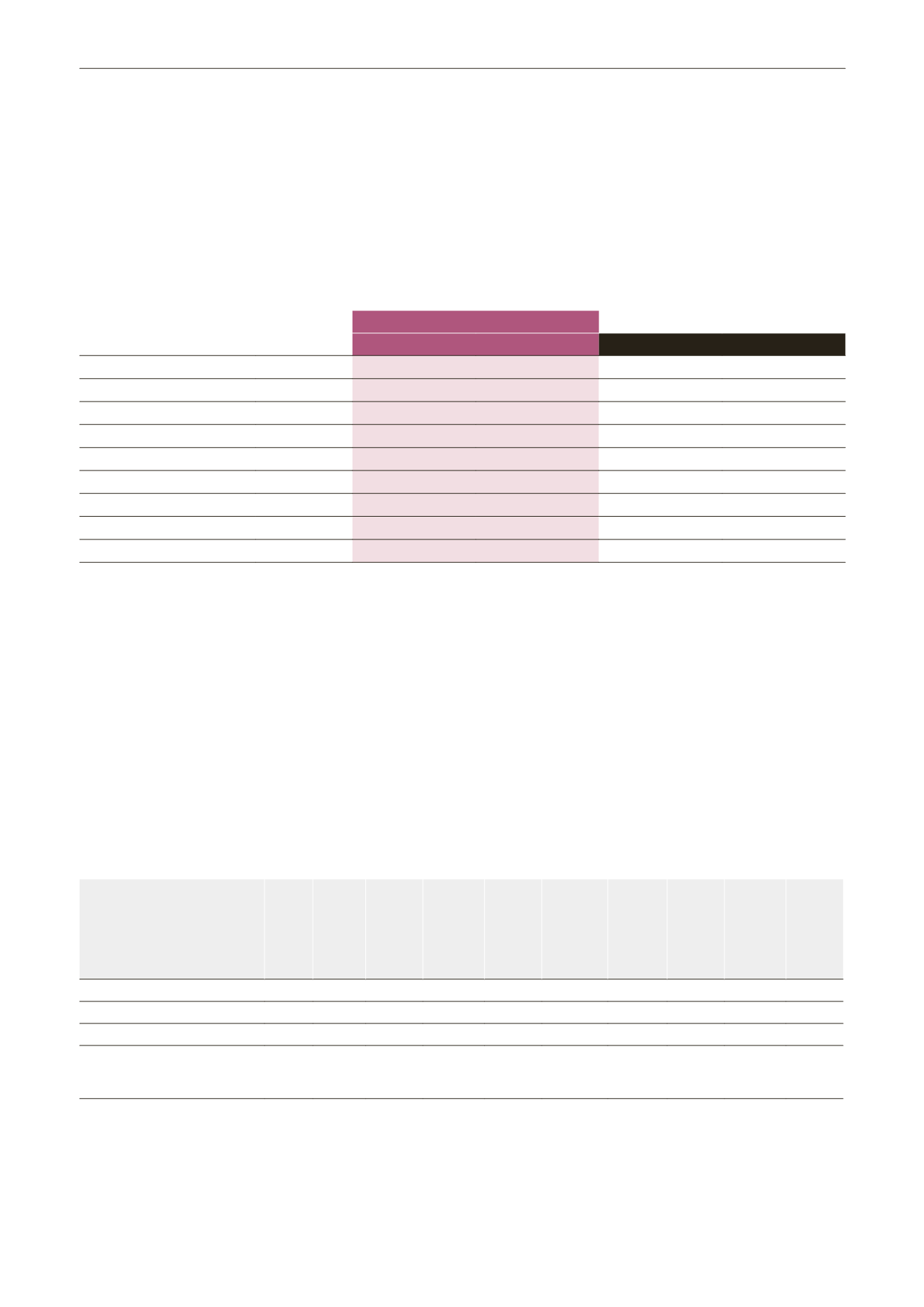

2.10 EARLY APPLICATION OF REVISED IAS 19

This note summarizes the main impacts of the first application of the revised IAS 19 standard on equity and financial statements

for the fiscal year 2011.

RESTATEMENT OF SHAREHOLDERS' EQUITY AS AT JANUARY 1, 2011

(in €'000)

Capital

stock

Capital-

linked

premiums

(Note 7.3)

Treasury

shares

Consolidated

reserves

Conversion

reserves

Other income

and expenses

recorded

directly as

shareholders'

equity

Profit for the

period, group

share

Group's

share of

shareholders'

equity

Minority

interests

Total

shareholders'

equity

Shareholders' equity ater January 2011

21,573 70,803 (15,202)

379,825 (2,392)

1,933

32,923 489,463

858 490,320

Adjustment of the actuarial liability

(3,120)

(3,120)

(3,120)

Related deferred taxes

1,125

1,125

1,125

Shareholders' equity at January 1, 2011,

restated of which total revenues and

expenses posted for the period

21,573 70,803 (15,202)

379,825 (2,392)

(62)

32,923 487,468

858 488,325