LISI 2012 FINANCIAL REPORT

66

3

Consolidated financial statements

that deal with contractual commitments, disputes and

authorizations for the purchase or disposal of assets;

• Review of sureties and guarantees as well as loan agreements

and any other banking commitments, in conjunction with the

banks and financial institutions;

• Review, together with both internal and external legal

counsels, of dispute and legal proceedings before the courts,

environmental questions, and the measurement of liabilities

that might arise;

• Examination of tax inspectors’ reports and reassessment

notices from previous financial years;

• Examination, together with those in charge of risk

management, insurance brokers and agents of the insurance

companies with which the Group has taken out its insurance

policies to cover risks in respect of contingent liabilities;

• Examination of transactions with related parties in respect of

guarantees or other commitments given or received;

• In general, review of all contracts and contractual

commitments.

2.7.4.1 COMMITMENTS GIVEN IN THE CONTEXT OF ORDINARY

OPERATIONS

In addition to the actual sureties stated in the note to this

document (cf. Note 2.5.6.3), and the operating leases whose

annual charges are presented in Note 2.5.1.2, commitments

provided as part of current activities are as follows:

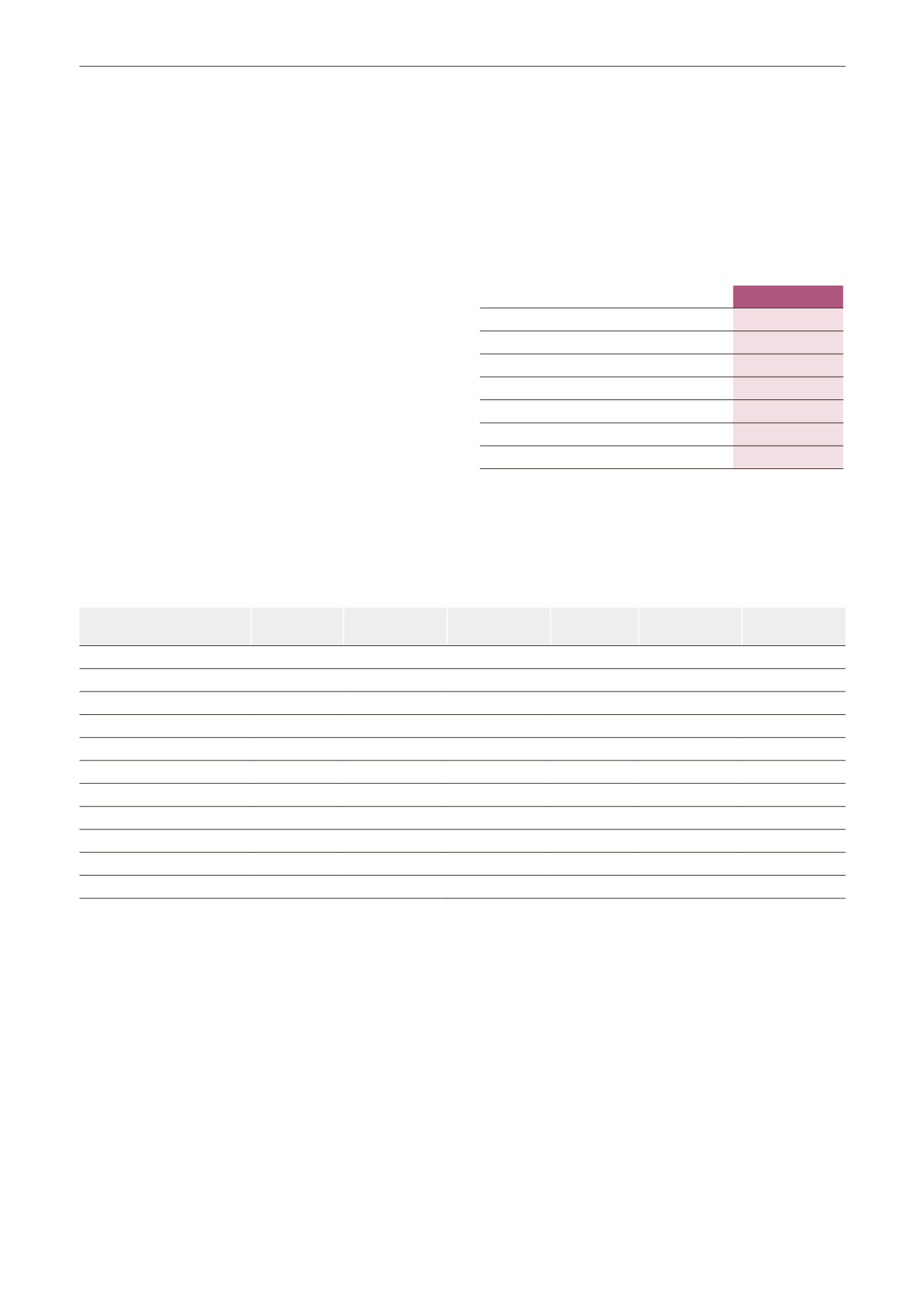

In €'000

2012

Miscellaneous guarantees

174

Training entitlements

5,533

Balance of investment orders

50,557

Commitments made

56,264

Rate swap

79,400

Foreign exchange hedging

79,717

Reciprocal commitments

159,117

Reciprocal commitments:

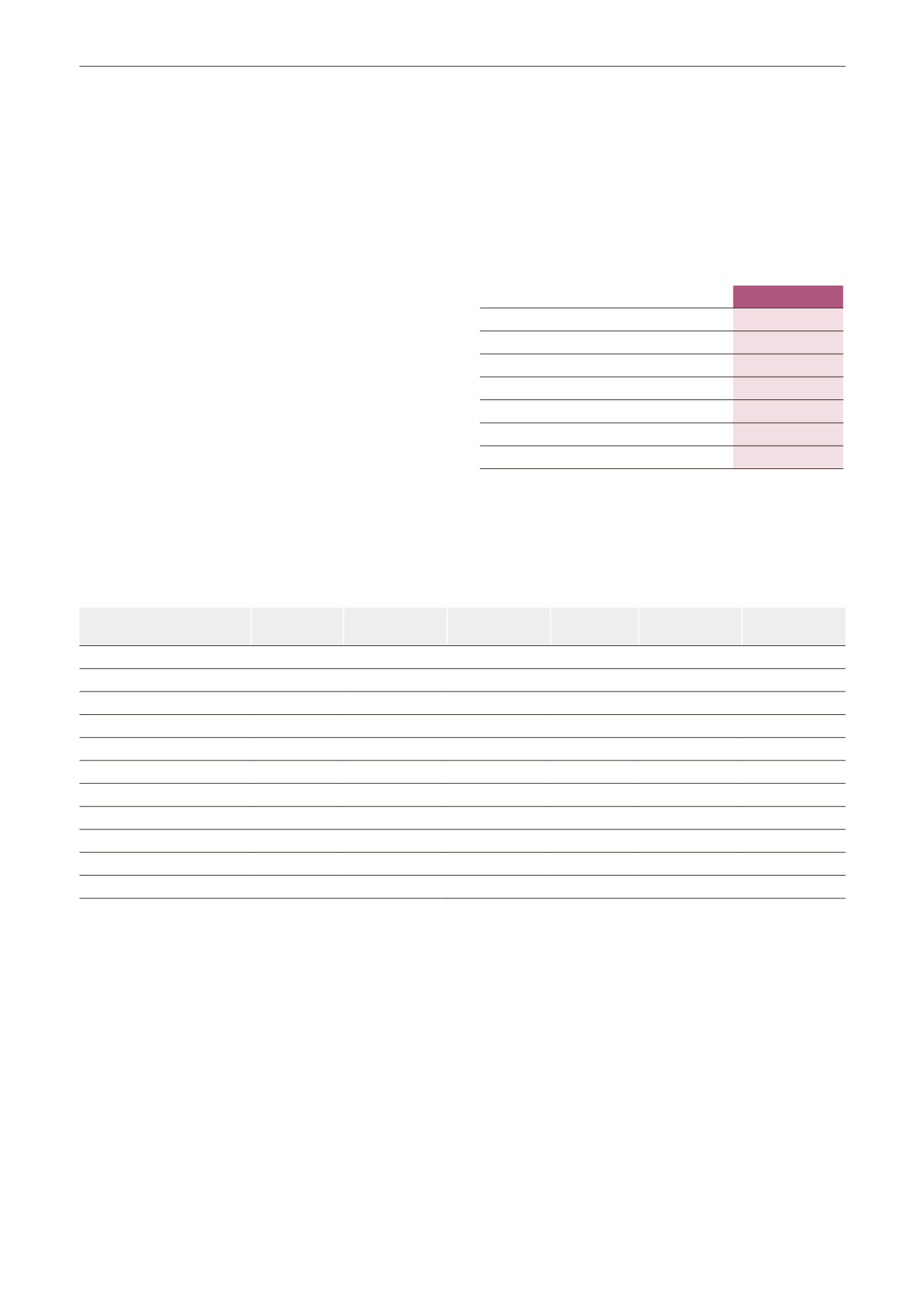

Reciprocal commitments are interest rate swaps to hedge

variable rate loans (cf. Note 2.5.6.1. Financial Debt) taken out to

fund external growth. At December 31, 2012, the features of

the swap contracts were as follows:

Notional at 12/31/2012

Face value In

€'000

Departure date Maturity date Paying rate Receiving rate

Net present value

in €'000

LISI S.A.

10,000

02/06/2009 02/06/2014

2.7800% Euribor 3 months

(328)

LISI S.A.

10,000

04/08/2009 10/08/2013

2.4900% Euribor 3 months

(234)

LISI S.A.

15,000

09/30/2011 09/30/2016

2.0730% Euribor 3 months

(403)

LISI S.A.

4,750

09/30/2011 09/30/2016

1.5900% Euribor 3 months

(98)

LISI S.A.

4,750

12/30/2011 12/30/2016

1.3925% Euribor 3 months

(83)

LISI S.A.

4,500

03/31/2012 06/30/2016

1.0750% Euribor 3 months

(143)

LISI S.A.

15,000

05/31/2012 05/31/2017

1.0700% Euribor 2 months

(384)

LISI AUTOMOTIVE Former

7,000

12/31/2010 12/29/2017

1.7450% Euribor 3 months

(179)

Seignol Hugueny

4,500

09/28/2012 09/30/2014

1.3000% Euribor 3 months

(60)

Creuzet Aeronautique

3,900

07/31/2012 07/31/2020

0.7750% Euribor 1 month

(32)

Total

(1,944)

2.7.4.2 COMMITMENTS RECEIVED AS PART OF ACQUISITIONS OF

COMPANIES

LISI AUTOMOTIVE:

• In the context of the takeover of the sites of Acument La

Ferté Fresnel, LISI AUTOMOTIVE was awarded by TEXTRON a

guarantee to cover environmental risks likely to threaten a site

with no industrial activity to date.

• As a liabilities hedging instrument, LISI AUTOMOTIVE enjoys

a hedging instrument for any unrealized liabilities discovered

over a two-year period as of the acquisition date.

2.7.4.3 GUARANTEES GIVEN AS PART OF THE DIVESTITURE OF

LISI COSMETICS

As part of the divestiture of LISI COSMETICS, a commitment for

compensation was granted in favor of the buyer concerning

any reassessments from the tax or environmental authorities