LISI 2012 FINANCIAL REPORT

65

3

Consolidated financial statements

2.7.2 Share-based payments

2.7.2.1 SHARE PURCHASE OPTIONS

Stock options are awarded to directors and certain employees

of theGroup. In accordancewith IFRS 2, “Share-Based Payment”,

these instruments result in the provision of shareholders’

equity instruments and are measured at grant date. The Group

uses the binomial method to measure them.

2.7.2.2 AWARD OF PERFORMANCE SHARES

Acting on the recommendation of the Compensation

Committee, LISI's Board of Directors decided, on July 28, 2010,

to allocate performance shares to members of the Executive

Committee and to members of the principle Management

Committees for the three LISI Group divisions, subject to their

meeting certain performance targets: the achievement of

these two criteria at the end of 2011, namely EBIT and sales

revenue, resulted in the completion of 85% of that plan in 2012.

The final cost was allocated to the divisions.

Acting on the recommendation of the Compensation

Committee, LISI's Board of Directors decided, on June 26, 2011,

to allocate performance shares to members of the Executive

Committee and to members of the main Management

Committees for the three LISI Group divisions, subject to their

meeting certain performance targets. The same went in 2012,

insofar as the Board of Directors of October 24, 2012 renewed

the opening of a new plan under similar conditions.

The fair value of these benefits has been calculated by

independent actuaries and is recognized in the income

statement on a straight-line basis throughout the entitlement

acquisition period.

The fair value of the benefits thus granted is recognized in 2012

in Payroll expenses for €1.5m for the employees of the French

companies, against shareholders' equity, and for €0.5m for the

employees of foreign companies, against Social liabilities. This

cost was not allocated to divisions, and remains an expense at

the LISI S.A. level until the definitive realization of the plan.

2.7.3 Related-party information / Remuneration of

members of management bodies

2.7.3.1 RELATED-PARTY INFORMATION

Related parties include the parent company, company

managers, directors and board members. There is no other

jointly-owned entity or entity recognized by equity method, or

joint shareholder, or business under joint control or significant

influence with which the LISI Group may have carried out

transactions worthy of investigation.

The only relationship of the Group with its parent company

(CID) is through the capital holding. On the other hand, LISI S.A.

provides support to its subsidiaries in the fields of accounting,

finance, strategy and law.

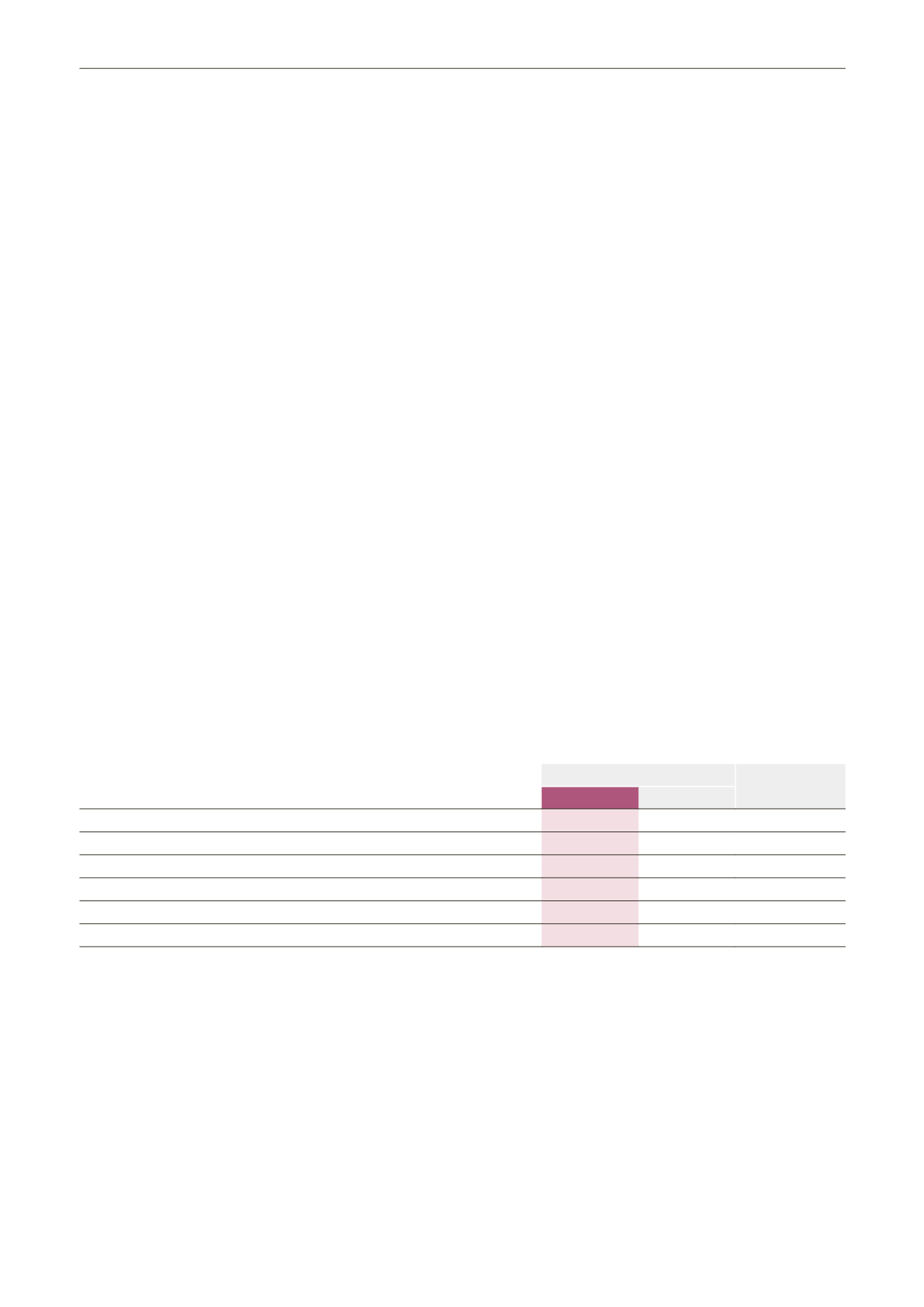

2.7.3.2 REMUNERATION OF MANAGERS AND DIRECTORS

(in €'000)

Expenses for the period

Liabilities

At 12/31/2012

2012

2011

Gross short-term benefits (salaries, bonuses, etc.)

871

759

Post-employment benefits (IFC)

306

229

306

Other long-term benefits

Termination benefits

Equity compensation benefits

63

43

63

Total compensation

1,240

1,030

368

The main directors will receive remuneration in the form of

short-term benefits, post-employment benefits and share-

based payments. With regard to this category, in 2009

and 2010 both directors of LISI S.A. received performance

shares in accordance with the same terms and conditions as

other members of the divisional Executive Committees; Two

additional conditions are also imposed in their case, namely, to

acquire 200 shares at the end of the acquisition period and to

keep a nominative portion of equity (200 shares) until the end

of their function as mandated chief executives of the mother

company.

2.7.4 Commitments

The Group draws up annually a detailed list of all contractual

commitments, financial and commercial commitments, and

contingent liabilities to which LISI S.A. and/or its subsidiaries

are party or exposed. This list is regularly updated by the

departments concerned and reviewed by Group Management.

In order to ensure that the information on this list is complete,

accurate and consistent, special control procedures have been

implemented, including in particular:

• The regular examination of the minutes of Shareholders’

General Meetings, Board Meetings, associated Committees