LISI 2012 FINANCIAL REPORT

19

2

Financial situation

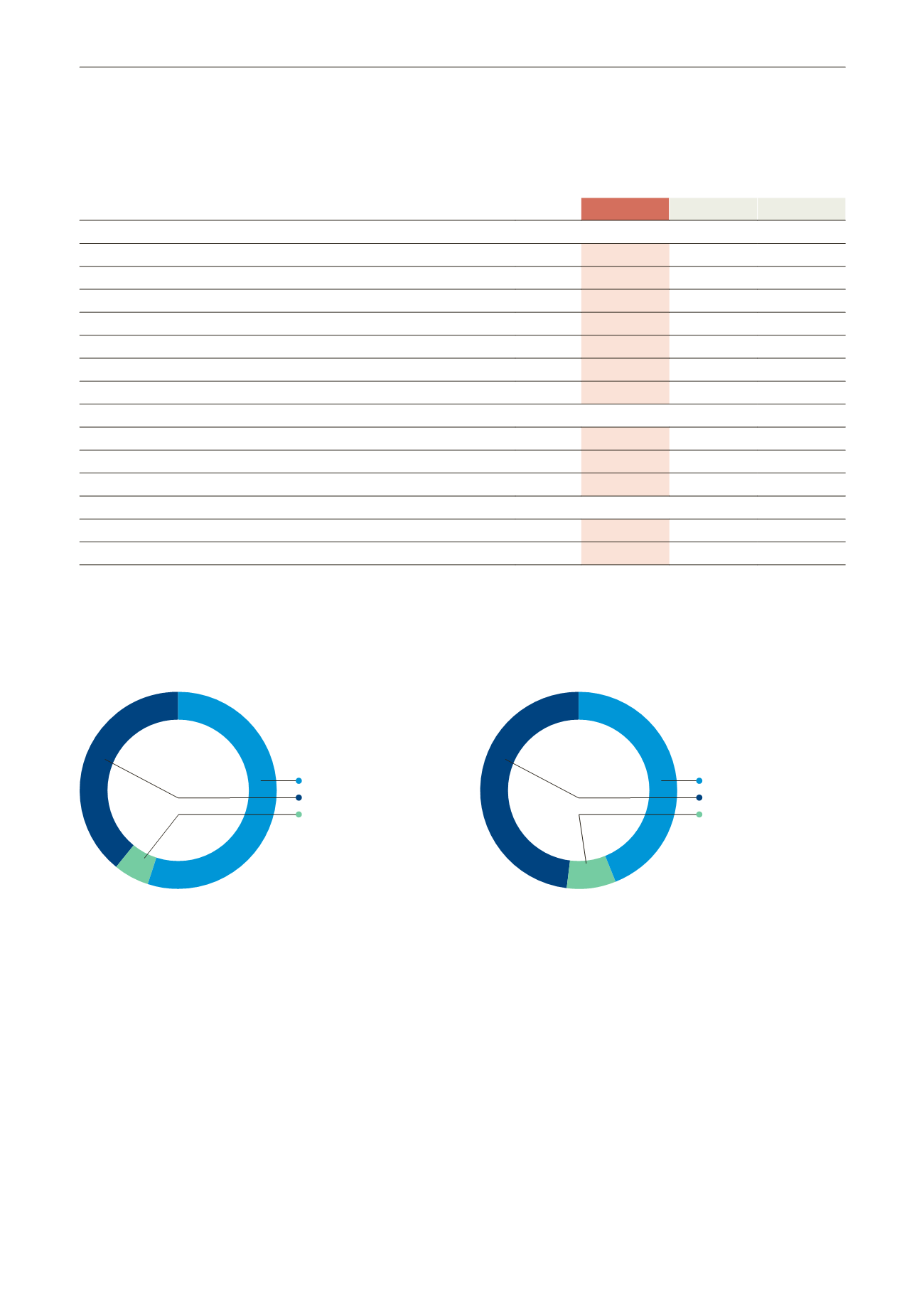

Activity summary at December 31,

12 months ending December 31,

2012

2011*

Changes

Key elements of the income statement

Sales revenue

€m 1,081.3

925.1

+16.9%

EBITDA

€m 154.8

122.1

+26.8%

EBITDA margin

%

14.3

13.2

+1.1 pts

EBIT

€m 100.4

78.1

+28.6%

Current operating margin

%

9.3

8.4

+0.9 pts

Earnings attributable to holders of company equity

€m

57.3

59.2

-3.2%

Net earnings per share

€

5.47

5.70

-4.0%

Key elements of the cash flow statements

Operating cash flow

€m 119.7

95.3

+25.6%

Net CAPEX

€m

-78.4

-64.9

+20.8%

Operating free cash flow (FCF)

1

€m

38.5

6.4

Key elements of the financial structure

Net debt

€m

76.7

102.6

- 25.2%

Ratio of net debt to equity

13.3%

19.1% -5.8 pts

* The Group anticipated as at January 1, 2012 the implementation of the revised IAS 19. The 2011 statements have been restated accordingly.

1 Free cash flow: operating cash flow from operations less net capital expenditures and changes in working capital requirements. See Chapter 3 note 2.5.2.4 Cash and

cash equivalents.

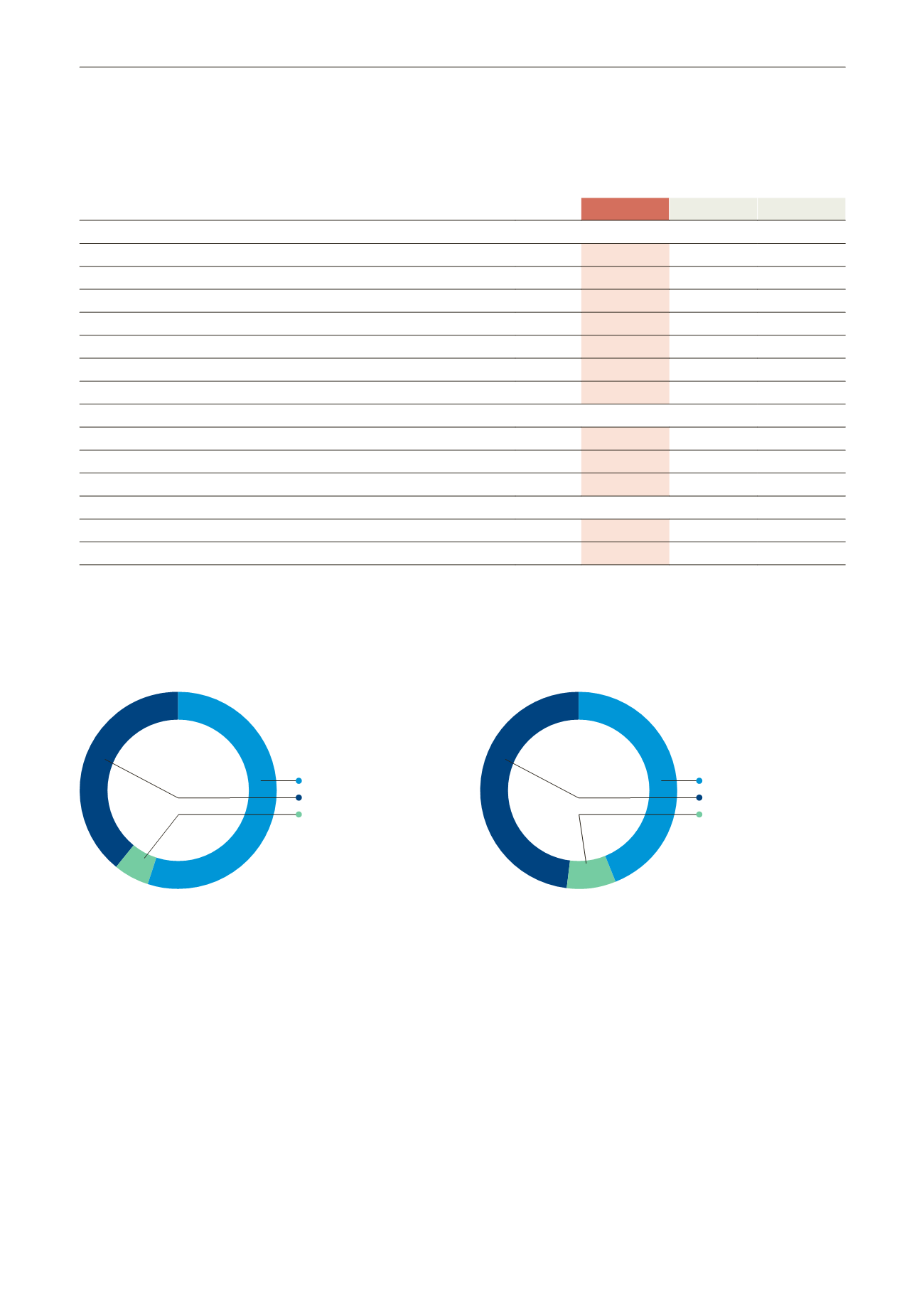

Breakdown of 2012 sales revenue

Breakdown of 2011 sales revenue

Following the acquisition of the Creuzet Aéronautique group

and thanks to strong organic growth at LISI AEROSPACE, the

Group now achieves over 55% of its sales revenues in the

aerospace field, as against 44% in 2011; automotive business

represents only 39%, as against 48% in 2011. LISI MEDICAL

contributes 6% to the consolidated sales revenues.

The Group has for several years conducted a strategy to gain

market share with its main customers by meeting their highest

standards for reliability and innovation. During fiscal 2012,

approximately 70 customers accounted for 80% of sales.

55%

LISI AEROSPACE

39%

LISI AUTOMOTIVE

6%

LISI MEDICAL

44%

LISI AEROSPACE

48%

LISI AUTOMOTIVE

8%

LISI MEDICAL