LISI 2012 FINANCIAL REPORT

26

2

Financial situation

Activity

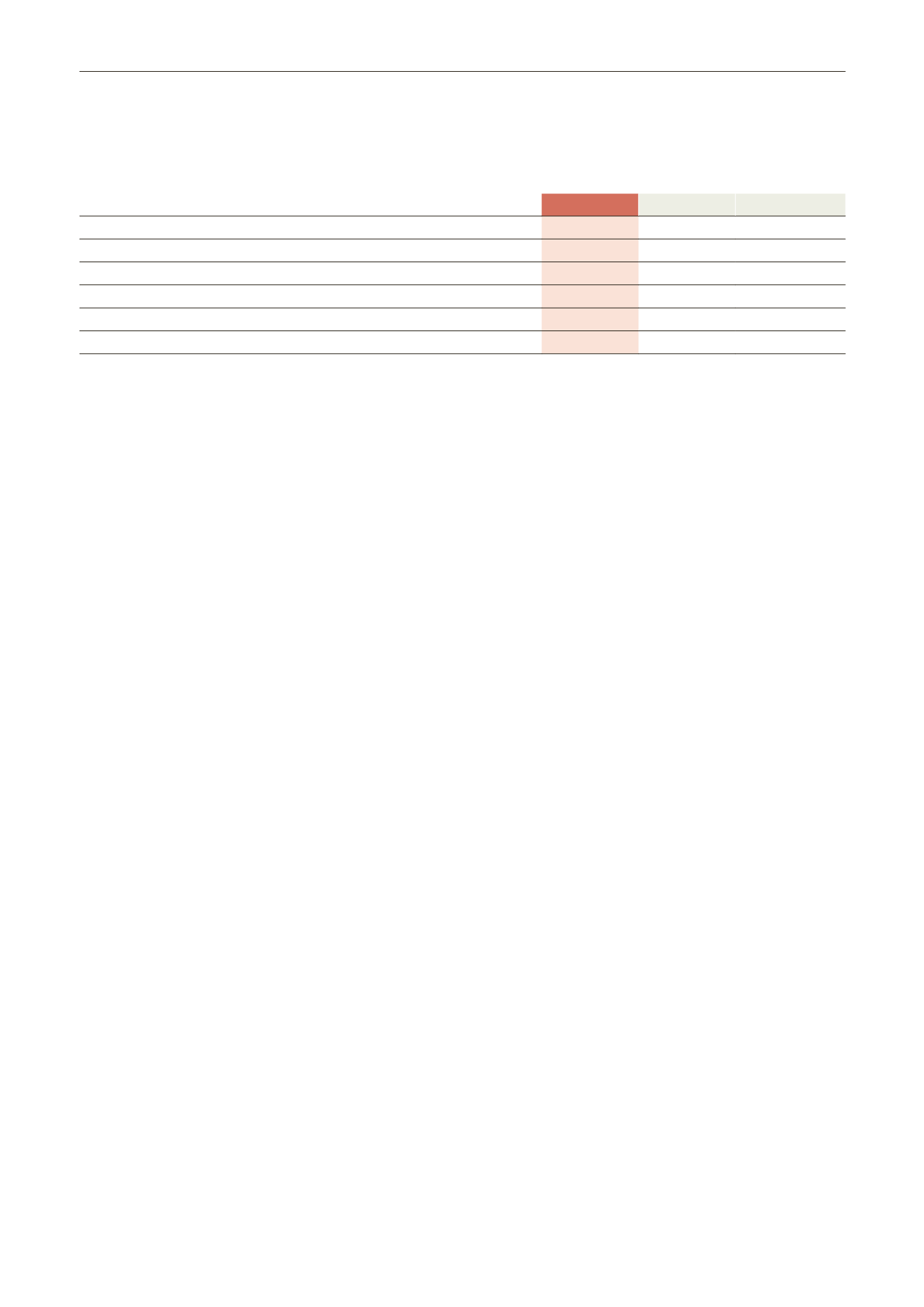

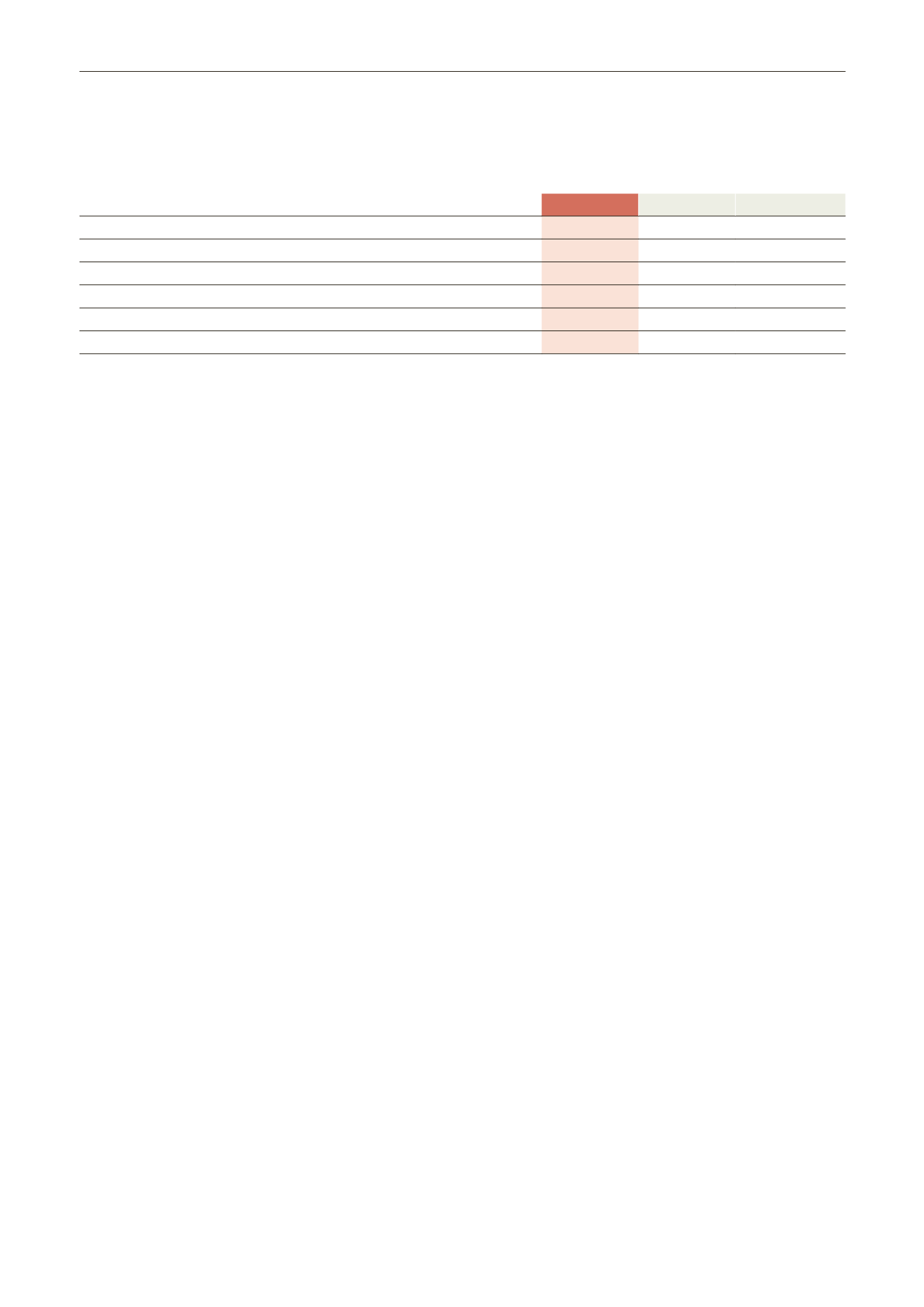

In €m

2012

2011**

Changes

Sales revenue

426.6

446.3

-4.4%

EBIT

2.3

23.7

-90.2%

Operating cash flow

22.3

28.7

-22.2%

Net CAPEX

-28.0

-35.6

-21.3%

Registered employees at period end

3,213

3,312

-3.0%

Full time equivalent head count*

3,263

3,406

-4.2%

* Including temporary employees

** The Group anticipated as at January 1, 2012 the implementation of the revised IAS 19. The 2011 statements have been restated accordingly.

The drop in volumes weighs heavily on the absorption of

fixed costs and especially productivity. Selling prices suffer

inertia from the price reductions granted and negotiated in

2011, while wage increases have a chisel effect of more than

€2 million.

In addition, the disposal of KUT deprives the division of

€4.8 million in sales compared to 2011 and of a fixed charge

coverage. One should also note a surcharge of €750k compared

to 2011 to launch new products that will produce their effect

in 2013.

The adjustment of variable costs (-9.6%) is correct, excluding

the payroll (+0.7%). However, the drop in volumes affects

the coverage of fixed costs that are down by only -2.2%. The

adjustment efforts, which began to take effect at the end of

the year, must accelerate in 2013.

Average annual manpower was down 143 out of a total

of 3,263 (-4.2%), which is insufficient to accommodate the

decrease in activity.

As a result, EBIT amounted to €2.3 million, compared to

€23.7 million achieved in 2011. The operating margin is only

0.5%, against 5.3% in the previous year. This collapse is mainly

due to the decrease in activity, the persistence of operating

difficulties at Puiseux, the non-adjustment of fixed costs and

significant accounting entries (non-monetary) in 2011 related

to the integration of the Bonneuil and La Ferté-Fresnel sites

(-€11.5 million compared to 2011).

Investment remained strong in terms of disbursements

at €28.0 million in 2012 against €35.6 million in 2011.

Commitments are at the same level of €29.3 million to address

the significant efforts put forth to improve productivity and

the necessary renewal of equipment (cold stamping), as well as

the deployment of the Movex 3 management system.

However, Free Cash Flow was resilient (-€4.1 million) due to

lower inventories, cash consumption remaining confined to the

division's debt.

OUTLOOK

No recovery was perceptible in January and one should rather

expect a stabilization of demand compared to the level of Q4.

If the firm JD Power (LMCA) expects a further decline in

the European market in 2013 (-3.2%), it considers that the

production of LISI AUTOMOTIVE customers in Eastern Europe

and Asia should remain strong.

Orders for the new PSA platform, the ones captured from

German manufacturers and from certain parts manufacturers,

will help amortize the market decline expected especially in

H1 2013.

The plan to adapt the "Focus" structures should help lower

fixed costs in the second half of 2013. The "Albatros" plan

aims to reduce by 40% the production surfaces at Puiseux

(Val d'Oise) and reduce costs in significant proportions. Finally,

concerning the "Nuts" plan, an analysis of the situation reveals a

structural, sustainable decline in one of the division's activities,

namely the manufacture of nuts for automobiles.

Therefore, in order to safeguard its competitiveness, LISI

AUTOMOTIVE Former introduced an industrial and commercial

project in the field of nuts.

An initial briefing and consultation of the Central Works

Council of LISI AUTOMOTIVE Former was held February 13,

2013. Management presented there the plan to gradually

consolidate the production of nuts on a limited number of

sites, whichwould eventually imply the shutdown of the Thiant

(Nord) site.

Aware of the social and human consequences that would result

from stopping the activities of the Thiant site (107 employees

concerned), LISI AUTOMOTIVE Former also introduced a Job

Protection Plan reflecting its commitment to do its best to

support its employees to the extent possible.