LISI 2012 FINANCIAL REPORT

24

2

Financial situation

Deliveries break down into 455 single-aisle aircraft (421 in 2011)

and 103widebody aircraft (87 in 2011), highlighting the success

of the A330 family whose monthly production rates have never

been that significant (9.5 in 2012 and 10 scheduled for spring

2013). The A380 was produced in 30 units (26 in 2011).

Development and industrialization of the A350 XWB are

continuing. The final assembly line is fully operational, and the

first flight is expected during the first half of 2013.

The launch of the A320 NEO is going according to plan and

most packages have been allocated during the year 2012.

The development phase of the A400M ends with more than

300 hours of operation and reliability of tests leading to the

civil and military certification is planned for the first quarter of

2013. The first delivery is scheduled for the second quarter of

2013, with a total of four deliveries by the end of the year (3 for

the French Air Force and for the Turkish army).

Boeing

Boeing ended the year 2012 with historically high performance,

with 1,203 net orders for commercial aircraft (the second best

year in its history) and 601 aircraft delivered, the best year since

1999. Such performance resulted from higher production rates

and for the 737 program, an unprecedented number of orders

(4,373 units) and deliveries:

• 1,124 net orders for the 737 family, with 914 orders for the

737 MAX,

• 46 B787s were delivered during the year,

• the 777 program totaled 83 deliveries,

• 31 aircraft in the Intercontinental and Cargo versions of the

new 747-8 were delivered in 2012.

Other aircraft markets

Thehelicoptermarketwas verywellmaintained, both for civilian

and military programs, with a growing market benefiting from

the acceleration of new programs.

Other markets such as business jets and regional aircraft

remained sluggish during the period, a trend that is expected

to continue in the short term.

Motorists

The aero-engine market was reorganized in 2012 and

competition toughened between the various players. The

market of engines for short-haul aircraft (A320 Neo, B737 Max)

is growing rapidly because of the very large backlog of their

respective manufacturers, Airbus and Boeing.

In this very important market in volume, competition is

organized between Pratt &Whitney with its NGPF Pure Power

engine and the GE-SNECMA alliance with its LEAP engine.

GE with its GP7000, GE90-115 range for widebody aircraft, the

B777 and A380, is continuing its ramp-up.

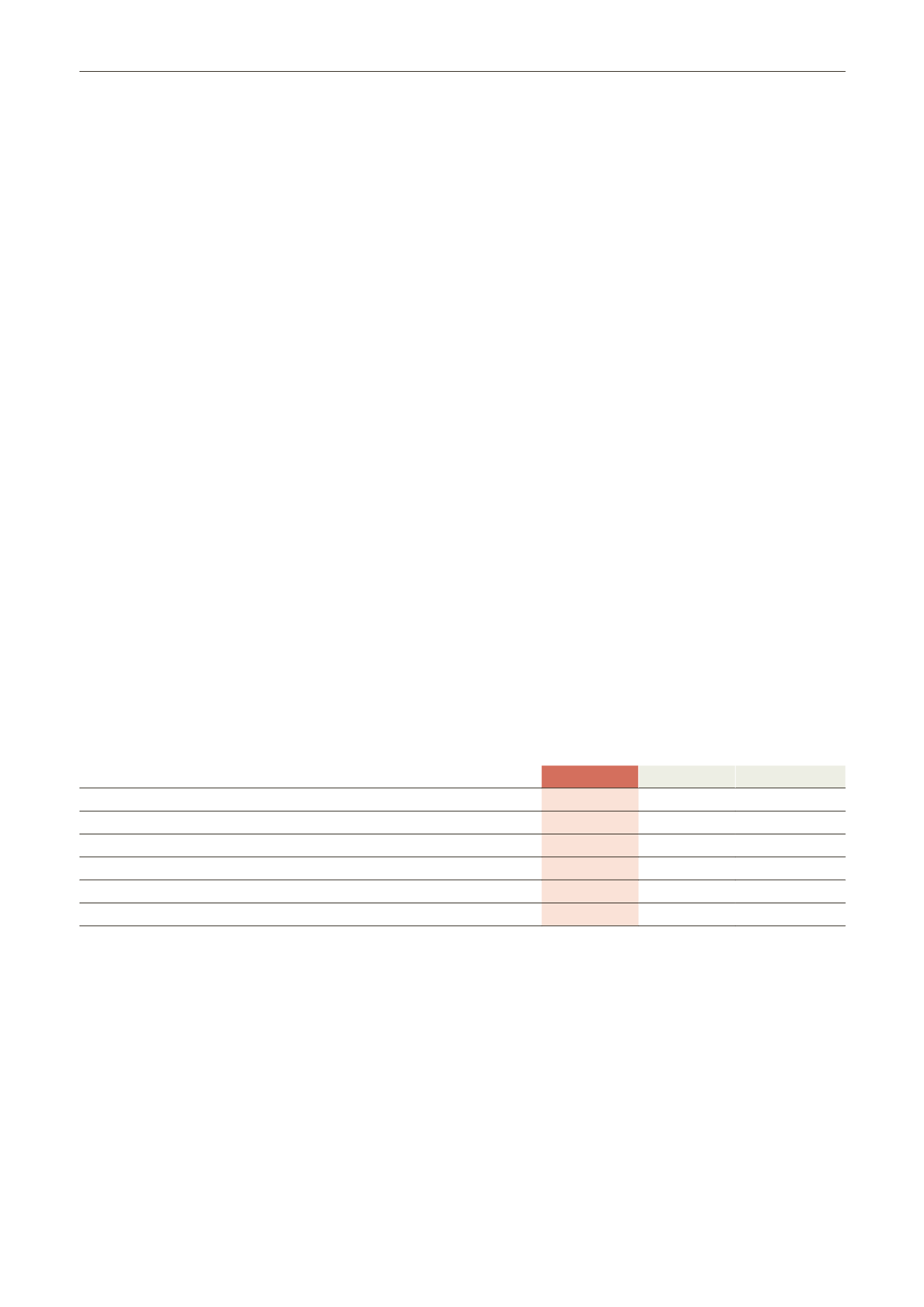

Activity

In €m

2012

2011**

Changes

Sales revenue

591.7

407.6

+45.1%

EBIT

91.3

51.1

+78.4%

Operating cash flow

87.6

57.0

+53.6%

Net CAPEX

-38.5

-25.0

+54.0%

Registered employees at period end

5,205

4,677

+11.3%

Full time equivalent head count*

5,456

4,141

+31.8%

* Including temporary employees

** The Group anticipated as at January 1, 2012 the implementation of the revised IAS 19. The 2011 statements have been restated accordingly.

In a business with high fixed costs such as the aerospace

components industry, the volume effect is key and may,

when ramp-up conditions are met, generate the expected

margin level to finance large investments and the working

capital requirements. The level of activity between the various

sites is balancing gradually, thereby contributing to a more

harmonious overall result.

Up 78.4% compared to 2011, EBIT reached €91.3 million and

the current operating margin stood at 15.4%, an increase of

2.9 percentage points in one year. This increase reflects the

volume effect mentioned above, a positive exchange rate

effect and hedging on the dollar (+€1.5 million) and a general

improvement in productivity (+€5.5 million). The fact that the

division was prepared since 2010, ahead of cycle, accounts

for the fact that the recovery could be absorbed under such

excellent conditions.

Hiring staff continued, concentrated on the Torrance site in

the United States (+ 100), Izmir - Turkey (+ 80) an in Casablanca

- Morocco (+84 people) to reach 5,456 full-time equivalents in

December 2012.