LISI 2012 FINANCIAL REPORT

9

1

General information regarding the company

5

Key figures

In €m

2012

2011

2010

2009

2008

Sales revenue

1,081.3

925,1

776,7

695,1

844,3

EBIT

100.4

76.6

49.5

34.2

98.9

Profit (loss) for the period

57.3

58.2

32.9

9.4

56.2

Shareholders' and minority interests' equity

576.0

542.5

490.3

450.6

458.6

Net debt

76.7

102.6

17.5

28.5

69.4

6

Information about the issuer

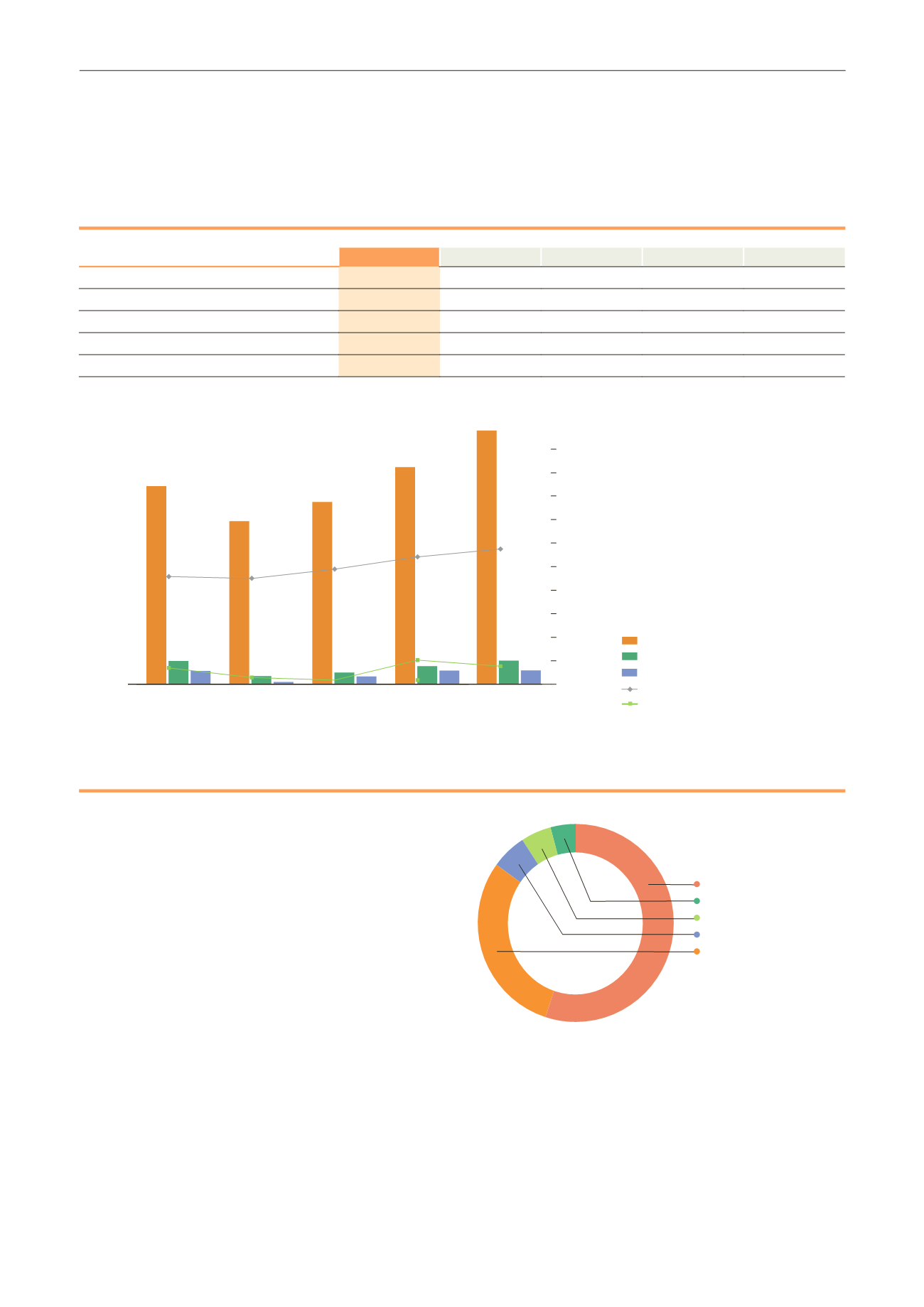

6.1 Breakdown of share capital

LISI share datasheet

ISIN code: FR 0000050353

Reuters: GFII.PA

Bloomberg: FII.FP

Compartment: B Eurolist

Stock marketplace: Euronext Paris

Number of shares: 10,786,494

Market capitalization at December 31, 2012: €666m

Indices: CAC® Small, CAC® Mid & Small,

CAC®-All tradable and CAC®-All Shares

* Including direct and indirect holdings:

VMC: 21.27%

FFP Invest: 18.97%

CIKO: 16.76%

** Reserved for performance share schemes.

Sales revenue

EBIT

Earnings for the period

Net debt

Shareholders' equity andminority interests

2008

2009

2010

2011

2012

1,000

900

800

700

600

500

400

300

200

100

0

€

695.1m

€

776.7

m

€

925.1

m

€

1,081.3

m

€

844.3m

55%

CID*

2,9%

Own shares**

5,1%

FFP Invest

6%

VMC

31%

Floating stock

(including employee

savings plans for 1.4%)