LISI 2012 FINANCIAL REPORT

112

7

Information regarding the Company and corporate governance

The new stock repurchase program provides that the stock

purchased will serve the following purposes:

•

To increase the activity of the stock on the market by an

Investment Services Provider via a liquidity contract in

accordance with the professional code of ethics recognized by

the AMF (the French stock market authority,

•

To grant stock options or free shares to employees and

corporate officers of the company and/or its consolidated

group,

•

To keep and use shares as consideration or payment for

potential future acquisitions,

•

To cancel shares purchased, subject to the approval of the

Shareholders’ Extraordinary Meeting to be called at a later

date.

The maximum purchase price may not exceed €100 per share.

Should derivative products be used, LISI S.A. will ensure that the

price of its shares is not made more volatile as a result.

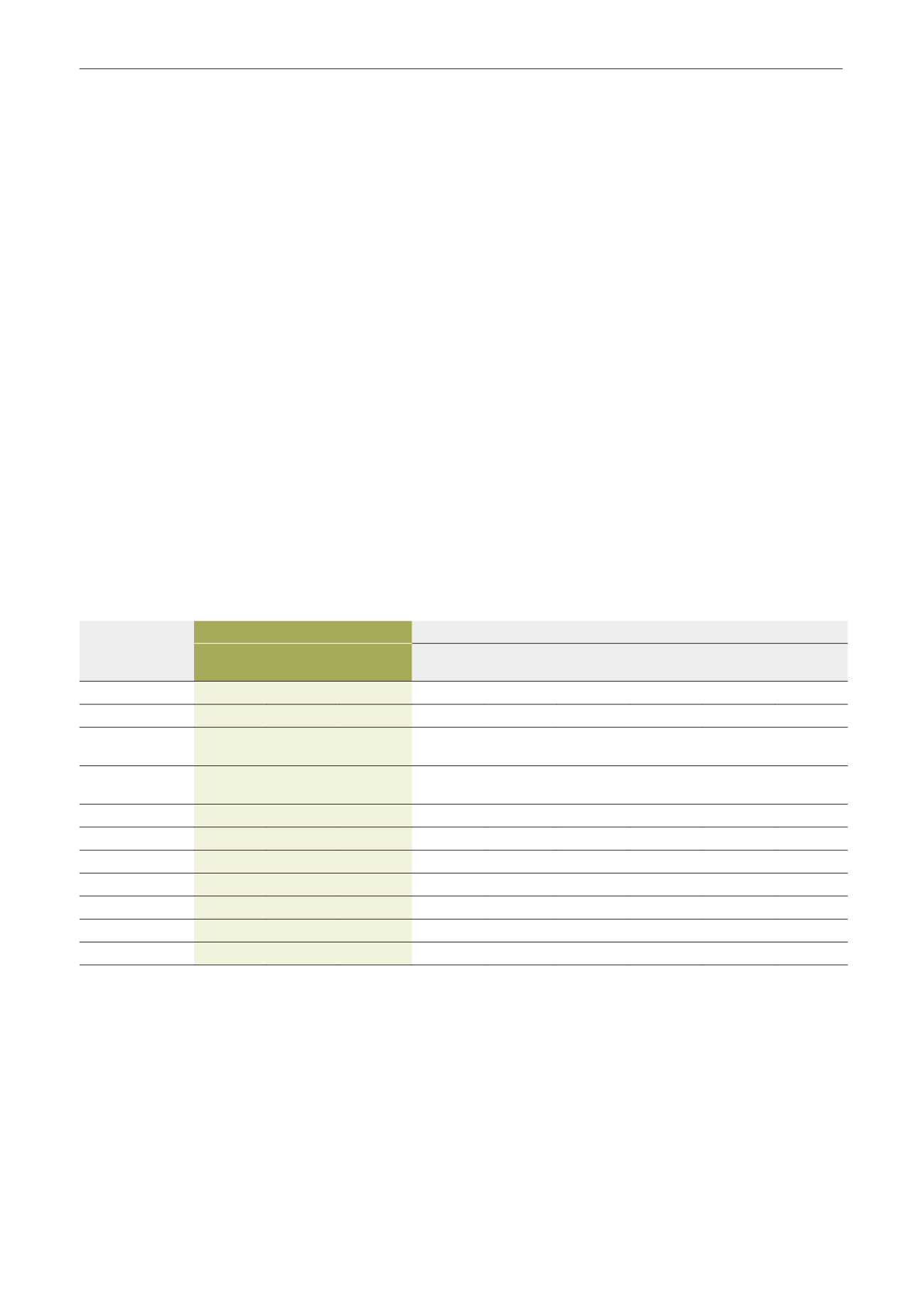

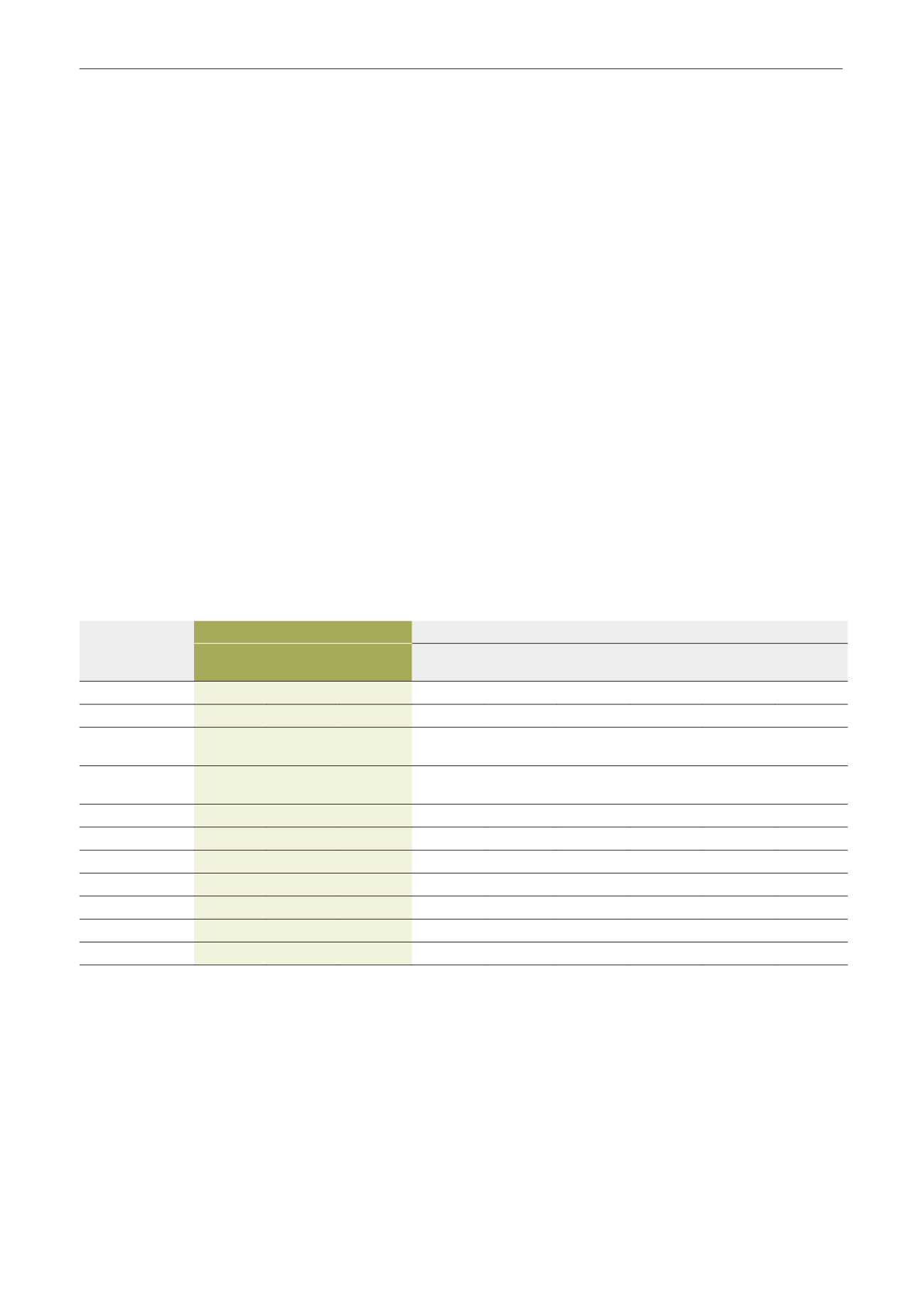

1.3 Breakdown of share capital and voting rights

1.3.1 Breakdown of share capital and voting rights over the past 3 years

1.3.1.1 Breakdown of share capital and voting rights

2012

2011

2010

as a % of

capital

as a % of

voting rights

in number

of shares

as a %

of capital

as a % of

voting rights

in number

of shares

as a %

of capital

as a % of

voting rights

in number

of shares

CID

55.0

69.3

5,928,724

55.00

69.6

5,928,724

55.0

67.8

5,928,724

VMC

6

7.5

640,675

6.00

7.5

641,675

6.0

7.3

641,675

Other corporate

officers

0.4

0.5

48,167

0.4

0.4

51,364

0.4

0.4

47,764

TOTAL CORPORATE

OFFICERS

61.4

77.2

6,617,566

61.4

77.5

6,621,763

61.4

75.5

6,618,163

of which directors

0.22

0.20

23,450

0.20

0.19

21,540

0.17

0.15

18,540

FFP INVEST

5.1

3.2

550,000

5.1

3.1

550,000

FFP

5.1

6.1

550,000

Treasury shares

2.9

314,980

3.5

378,804

3.9

420,876

Employees

1.4

0.9

152,500

1.4

0.9

146,500

1.4

0.9

152,570

Public

29.2

18.7

3,151,448

28.6

18.5

3,089,427

28.3

17.5

3,044,885

GRAND TOTAL

100.0

100.0 10,786,494

100.0

100.0 10,786,494

100.0

100.0 10,786,494

Shareholders or groups of shareholders controlling

more than 3% of share capital

– The sole activity of CID, a company based at 28 Faubourg

de Belfort 90100 DELLE, is the ownership of LISI shares. At

December 31, 2012, it holds: 55% of the share capital and

69.3% of the voting rights.

CID’s capital is held in almost equal proportion by three family

shareholder groups through family holdings. While family ties

exist between shareholders, they are not directly related.

– At December 31, 2012, VMC, Route des Forges 90120

MORVILLARS, holds directly: 6.0% of the share capital and

7.5% of the voting rights. At the same date, it holds indirectly

15.27% of the capital of LISI S.A., i.e. in total 21.27% of the

capital.

– At December 31, 2012, FFP, 75 avenue de la Grande Armée

75116 PARIS, holds: 5.1% of the share capital and 3.2% of the

voting rights. At the same date, it holds indirectly 13.87% of

the capital of LISI S.A., being a total of 18.97% of the capital.