LISI 2012 FINANCIAL REPORT

115

7

Information regarding the Company and corporate governance

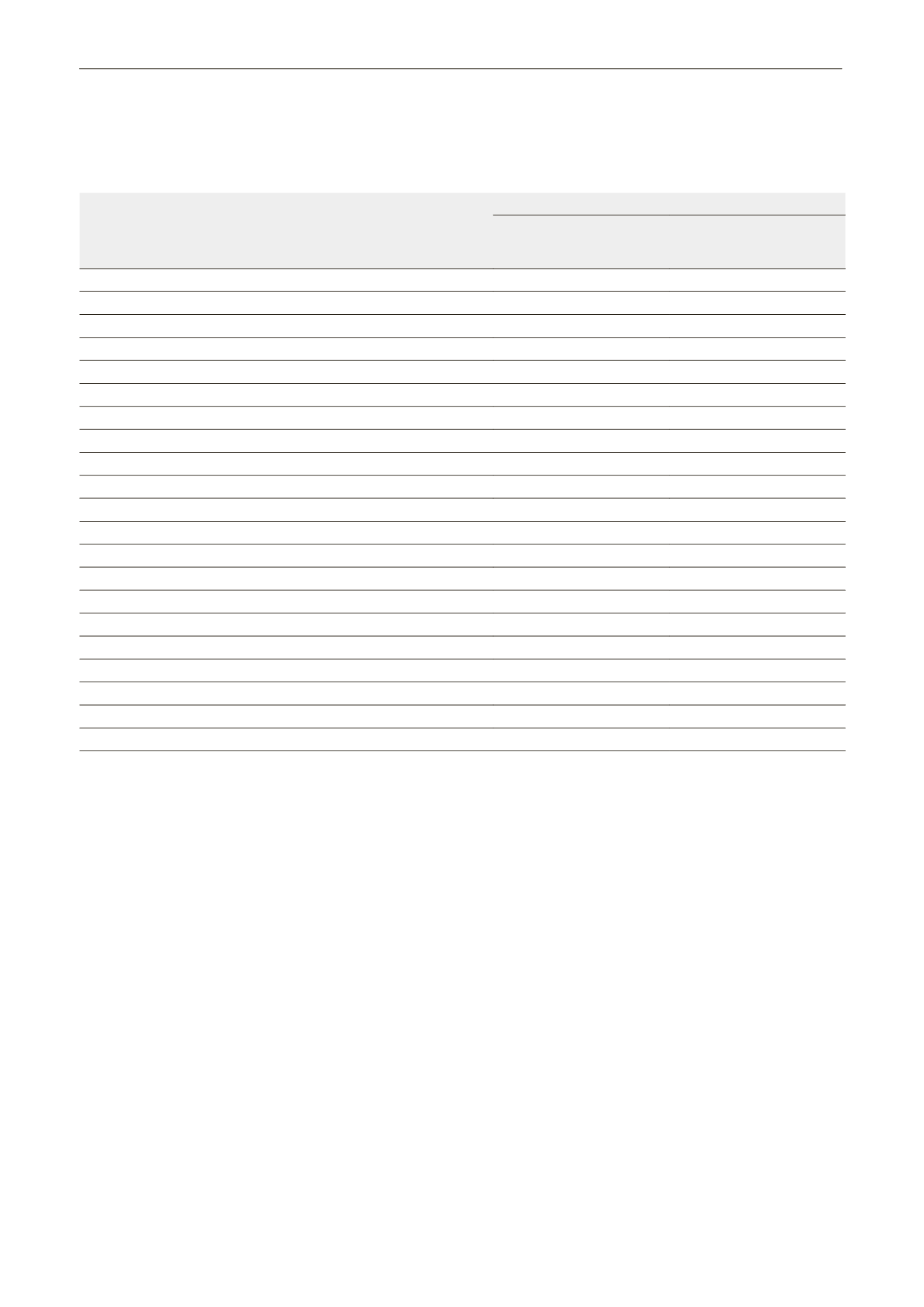

Data with related companies are as follows:

(In €'000)

Amount concerning

related companies

companies with which the

company has an ownership

relationship

ASSETS:

Provisions on equity shares

Receivables related to equity holdings

10,500

-

Debtors and apportioned accounts

2,430

-

Cash advances to subsidiaries

174,495

-

Tax integration current account

8,018

-

LIABILITIES:

Subsidiaries’ financial assistance

122,184

-

Tax integration current account

590

-

Advance payments from customers

-

-

Suppliers

138

-

Other creditors

-

-

INCOME STATEMENT:

Services received

-

-

IT maintenance

17

-

Reserves for equity interests

788

-

Sales revenue with subsidiaries

6,832

-

Miscellaneous chargebacks

1,587

-

Revenues from subsidiaries' loans and current accounts

2,049

-

Revenues from equity interest

13,003

-

Reversal of provisions on equity interests

-

-

Significant intra-group items include:

• On the assets side:

- Receivables relating to equity interests: LISI S.A. advanced, as

a mid-term loan, €25m to its subsidiary LISI AUTOMOTIVE. A

loan contract of €10millionwhichwas entered into on July 15,

2005 for a period of seven years, redeemable on or after July

15, 2011 for a full refund onApril 1, 2016, allowed it to partially

finance the acquisition in July 2005 of Germany's KNIPPING. A

€10 million loan was taken out in April 2008 for a period of

7 years, amortizable, with 2 years' deferred repayment to

face its growing working capital requirements, the capital

outstanding at December 31, 2012 being €4 million.

- cash advances to group subsidiaries as part of the Group's

cash agreement,

- thecurrentaccountsforthefiscalintegrationoftaxreceivables

of the companies consolidated within the group.

• On the liabilities side:

- cash granted to group subsidiaries within the group cash

management agreement,

- thecurrentaccountsforthefiscalintegrationoftaxreceivables

of the companies integrated within the group.

• On the income statement:

- invoices for services andmanagement fees from LISI S.A. to its

various subsidiaries,

-dividends received by LISI S.A. during the financial year 2012.

These transactions are entered into under normal market

conditions; in particular, they take into account costs that were

actually incurred and are billed back.