LISI 2012 FINANCIAL REPORT

111

7

Information regarding the Company and corporate governance

1.1.3 Authorized share capital not yet issued

At December 31, 2012 there are more valid delegations granted

by the Shareholders’ General Meeting to the Board in the area

of capital increases.

1.1.4 Potential warrants

At December 31, 2012, there are no more warrants providing

access to capital.

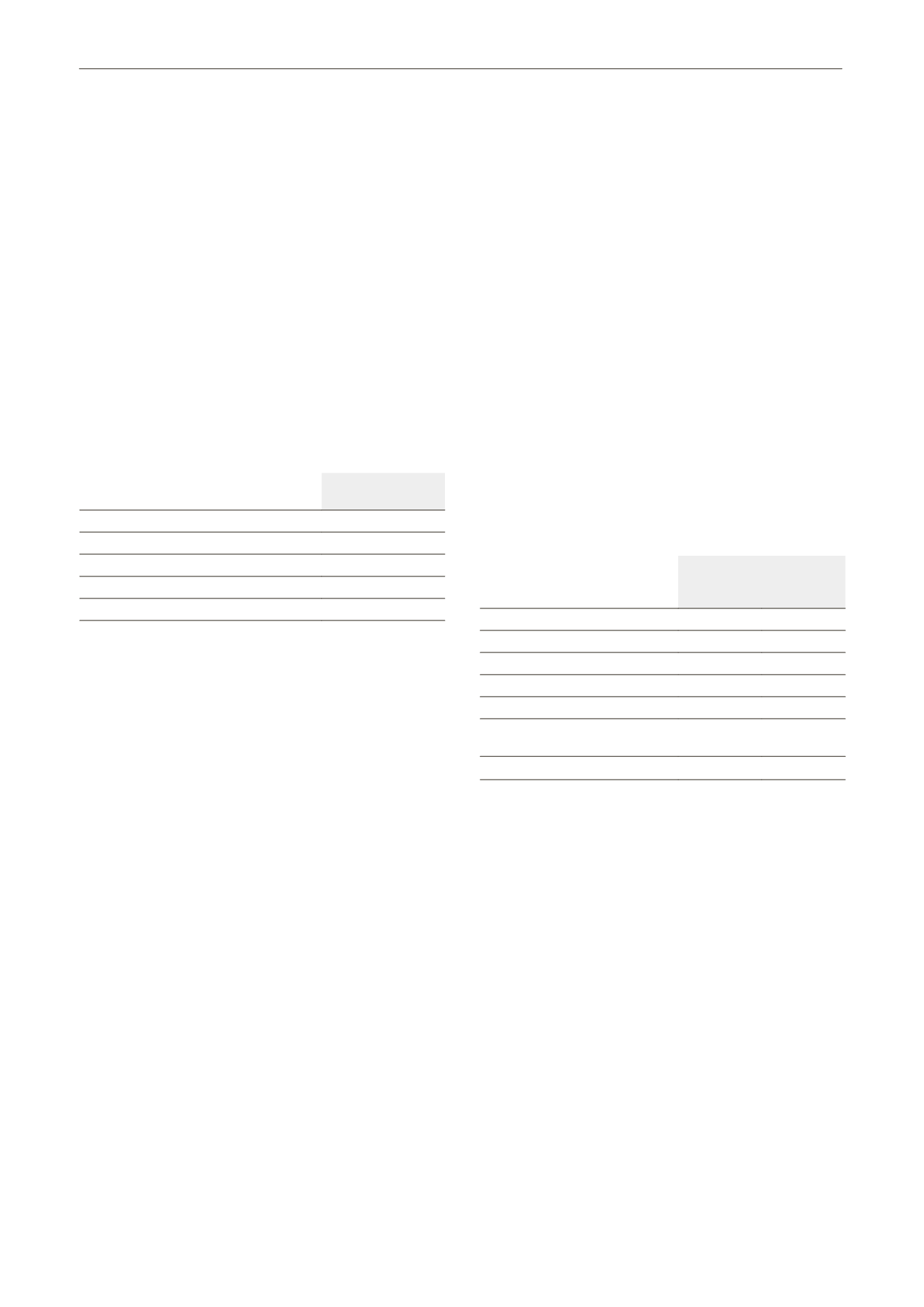

1.1.5 Dividend distribution policy for the past five years –

Dividend prescription period

The distributable profit is at the disposal of the Shareholders’

General Meeting, which determines its allocation.

In the past 5 years, dividends paid out per share have been as

follows:

Net dividend

in €

2008

1.20

2009

0.70

2010

1.05

2011

1.30

2012

(1)

1.40

(1) Subject to the decision of the Ordinary General Meeting of April 25, 2013. The

date for payment of dividends has been set at May 7, 2013.

The timeframe for paying dividends is 9 months as of the year-

end date. Unclaimed dividends are waived to the State after a

period of 5 years beginning of the payment date.

1.2 Stock repurchase program

1.2.1 In place at December 31, 2012

On April 26, 2012, the Shareholder’s mixed Meeting authorized

the company to repurchase up to 10% of its own shares in the

open market for a period of 18 months, i.e. up until October

26, 2013.

Thus, LISI S.A. plans to launch a stock repurchase program for

the following purposes, in decreasing order of importance:

•

To increase the activity of the stock on the market by an

Investment Services Provider via a liquidity contract in

accordance with the professional code of ethics recognized by

the AMF (the French stock market authority);

•

To grant stock options or free shares to employees and

corporate officers of the company and/or its consolidated

group;

•

To keep and use shares as consideration or payment for

potential future acquisitions;

•

To cancel shares purchased, subject to the approval of the

Shareholders’ Extraordinary Meeting to be called at a later

date.

The following terms apply to this authorization:

•

The company may not repurchase its own shares for more

than €100, not including transaction fees.

The highest figure that LISI S.A. would pay if it purchased shares

at the ceiling price set by the Shareholders’ Meeting, i.e. €100,

is €69,984,500.

Under the above-mentioned share repurchase program, in

2012 LISI S.A. acquired 121,223 treasury shares, i.e 1.1 %. The

number of own shares held by LISI S.A. stands at 314,980.

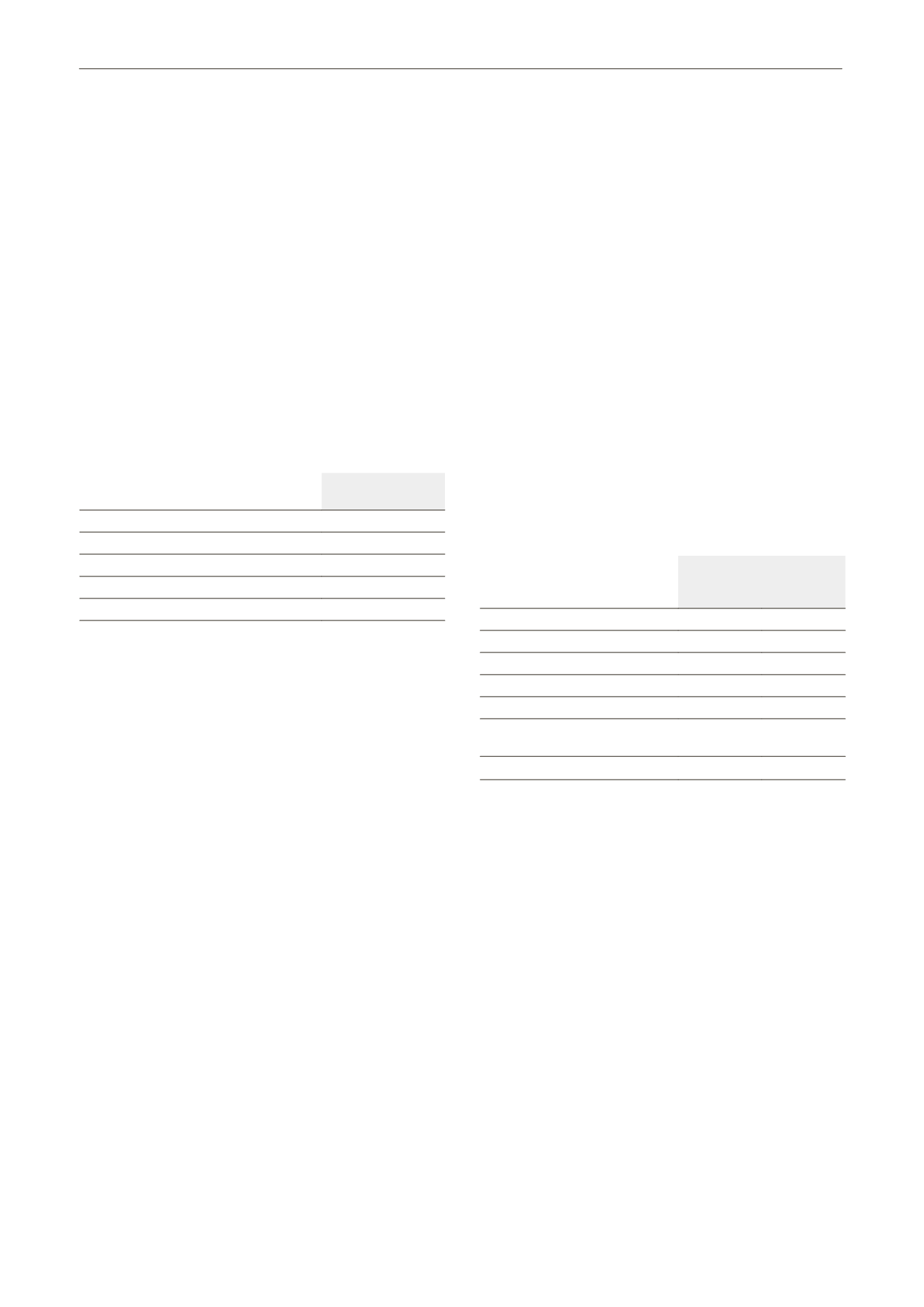

The operations carried out by the Company on its own shares

are summarized in the table below:

Number of

shares

Average

weighted price

in €

Shares held at 01/01/2012

378,804

38.48

Shares acquired in 2012

121,223

54.83

Shares awarded in 2012

(47,185)

37.32

Shares disposed of in 2012

(137,862)

54.46

Shares held at 12/31/2012

314,980

37.95

Of which shares allocated to

remuneration in shares

302,439

Of which available

12,541

Shares have been purchased and sold within the scope of the

market-making contract with Oddo Corporate Finance. The

market-making contract complies with the ethical charter of

the AFEI.

1.2.2 New stock repurchase program

The next Shareholders' General Meeting will be offered to

renew its program to repurchase LISI S.A. shares, in accordance

with the new rules applicable since the entry into force of

European Rules Nr.2273/2003 of December 22, 2003. LISI S.A.

offers to acquire a number of shares representing up to 10% of

the number of shares that make up its capital stock, except for

the acquisition of shares meant to be kept and the delivery of

shares against or as payment for external growth operations,

if applicable, whose total number will be limited to 5% of the

equity, i.e. 539,324 shares.

The duration of the stock repurchase program is set at 18

months.