80

80

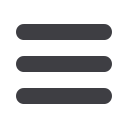

INCOME STATEMENT

(in thousands of euros)

12/31/2018

12/31/2017

Sales revenue

1,645,095 1,643,356

Changes in stock, finished products and

production in progress

9,251

(884)

Total production

1,654,346 1,642,472

Other revenues(a)

39,641

26,661

Total operating revenues

1,693,987 1,669,133

Consumed goods

(464,424)

(443,119)

Other purchases and external expenses

(352,485)

(338,332)

Taxes and duties

(11,615)

(12,171)

Personnel expenses (including temporary

workers)

(640,048)

(619,333)

EBITDA

225,416 256,178

Depreciation

(99,025)

(90,132)

Net provisions

9,166

5,352

Current operating profit (EBIT)

135,558 171,398

Non-recurring operating expenses

(13,693)

(7,329)

Non-recurring operating revenues

3,427

3,649

Operating profit

125,290 167,718

Financing expenses and revenue on cash

(2,503)

(2,421)

Revenue on cash

3,462

3,445

Financing expenses

(5,965)

(5,866)

Other interest revenue and expenses

7,847

(19,166)

Other financial items

42,635

60,852

Other interest expenses

(34,788)

(80,018)

Taxes (including CVAE

(Tax on Companies’ Added Value))

(33,839)

(39,182)

Profit (loss) for the period

96,794 106,951

Attributable as company shareholders’

equity

92,069 107,965

Interest not granting control over the

company

4,725

(1,014)

Earnings per share (in €)

1.73

2.04

Diluted earnings per share (in €)

1.72

2.02

(a) In order to provide readers of the financial statements with better information

that is in accordance with international standards, in the 2018 financial state-

ments the Company has continued classifying revenues related to CIR

(Research tax credit) as “Other Revenues”.

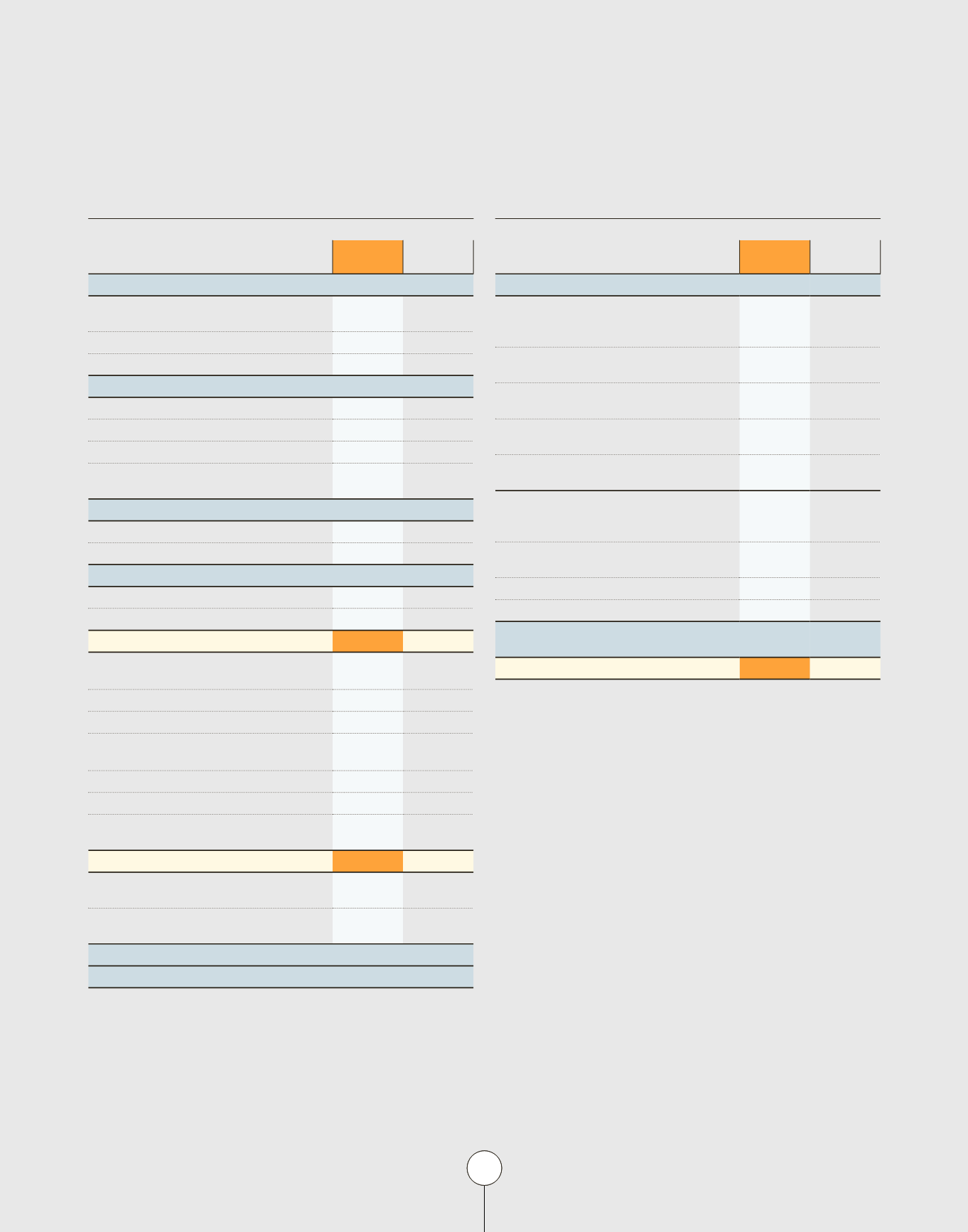

STATEMENT OF OVERALL EARNINGS

(in thousands of euros)

12/31/2018

12/31/2017

Profit (loss) for the period

96,794 106,951

Other items of overall income applied

to shareholders equity

Actuarial gains and losses out of employee

benefits (gross element)

(3,986)

671

Actuarial gains and losses out of employee

benefits (tax impact)

907

(302)

Restatements of treasury shares

(gross element)

(422)

220

Restatements of treasury shares

(tax impact)

122

(64)

Other items of overall income that will

cause a reclassification of income

Exchange rate differences resulting from

foreign business

3,794 (19,251)

Hedging instruments (gross element)

(12,004)

25,361

Hedging instruments (tax impact)

3,199

(7,085)

Other portions of global earnings,

after taxes

(8,389)

(451)

Total overall income for the period

88,404 106,500

Hedginginstrumentsconsistmainlyofforeignexchangehedginginstrumentsand,toa

lesserextent,rawmaterialhedginginstruments.Thenegativeamountof€12.0million

is due mainly to the rise in the USD, which resulted in a symmetrical decrease in the

fairvalueofthehedginginstrumentsputinplacetoprotectagainstthefalloftheUSD.

FINANCIAL DATA