78

78

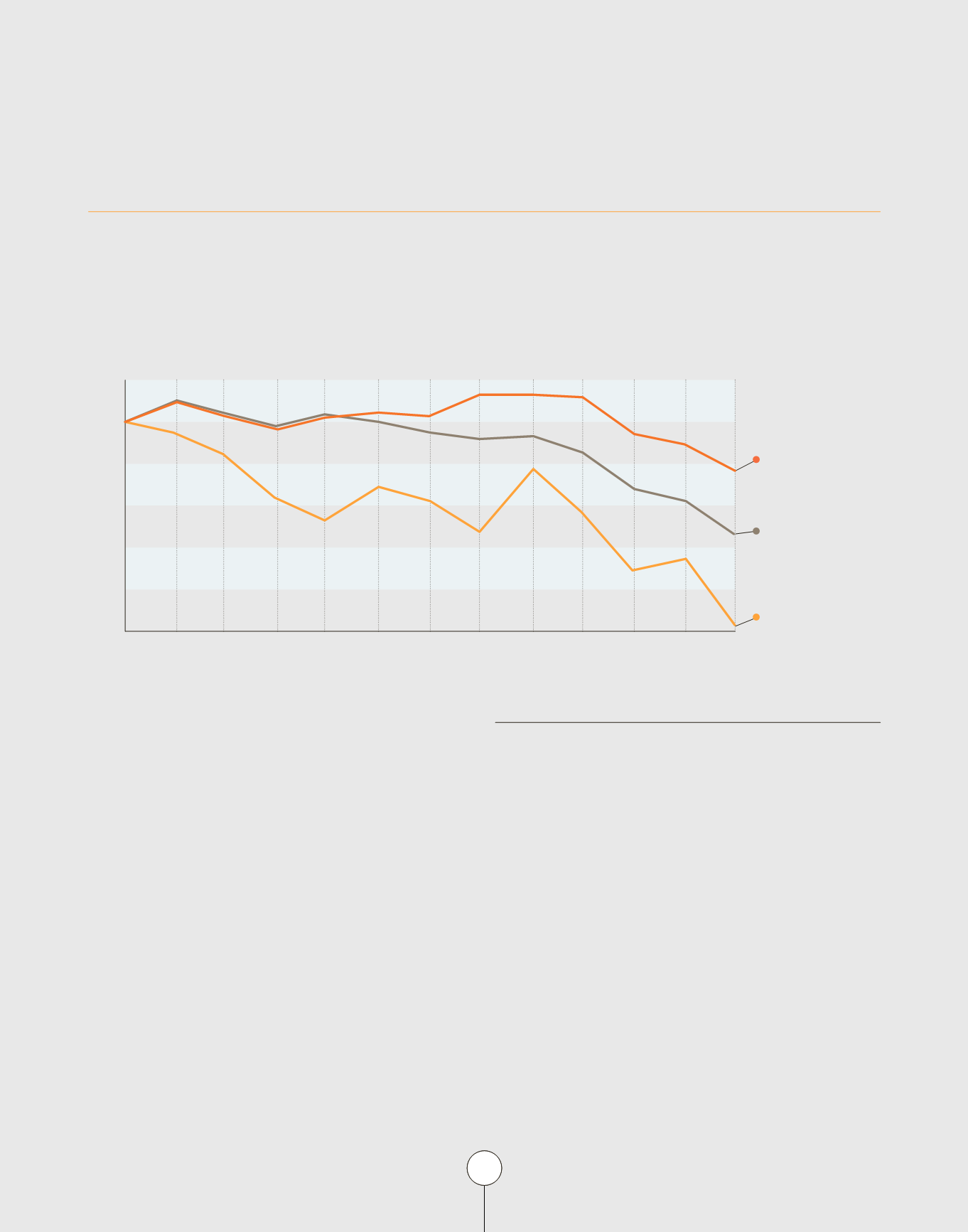

The LISI share underwent a sharp correction in 2018 after a

fairly encouraging start and an all-time high of € 41.75 per

share in January 2018. Such sharp decline is the result of a

difficult stockmarket environment inwhich small stocks have

come under pressure, particularly those exposed to the

automotivemarket. All comparable companies had their share

prices adjusted in equivalent proportions.

The year-end price is in the lowest annual levels after the

downturn that has been observed since October 2018. The

lowest price recorded was € 18.80 in December.

In terms of volume, 7,803,749 shares were traded over the

year, once more rising (+5%) in the past 3 consecutive years

for capital down -8%. In total, nearly 44% of the float was

traded.

Coverage of the stock

The stock is followed by 6 stockbrokers who regularly issue

research notes accompanied by opinions and objectives corre-

sponding to the assessment by the analyst in charge. This

cover makes it possible to obtain full and diverse information

for professional or private investors.

The LISI Group takes part in a large number of conferences,

roadshows and investor meetings for the cities of Cape Town,

London, Lyon, New York, Nice and Paris. In total, the

management of LISI met withmore than 260 investors during

the 2018 financial year.

The communication policy is based on complete and

transparent communication, a presentation of the results

along with the semi-annual and annual publications and on

the assessment of the forecasts by the panel of analysts based

on their macro-economic assumptions.

-48.9%

LISI

-12.2%

ESTX InduGd&Ser

-26.8%

CAC Small Index

50

60

70

80

90

100

110

DEC

NOV

OCT

SEP

AUG

JUL

JUN

MAI

APR

MAR

FEB

JAN

-48.9%

SHARPCORRECTIONOFTHE

STOCKPRICE IN2018

LISI’S PROGRESS OVER 2018

€20.50

PER SHARE AS AT 12/31/2018

STOCK MARKET DATA