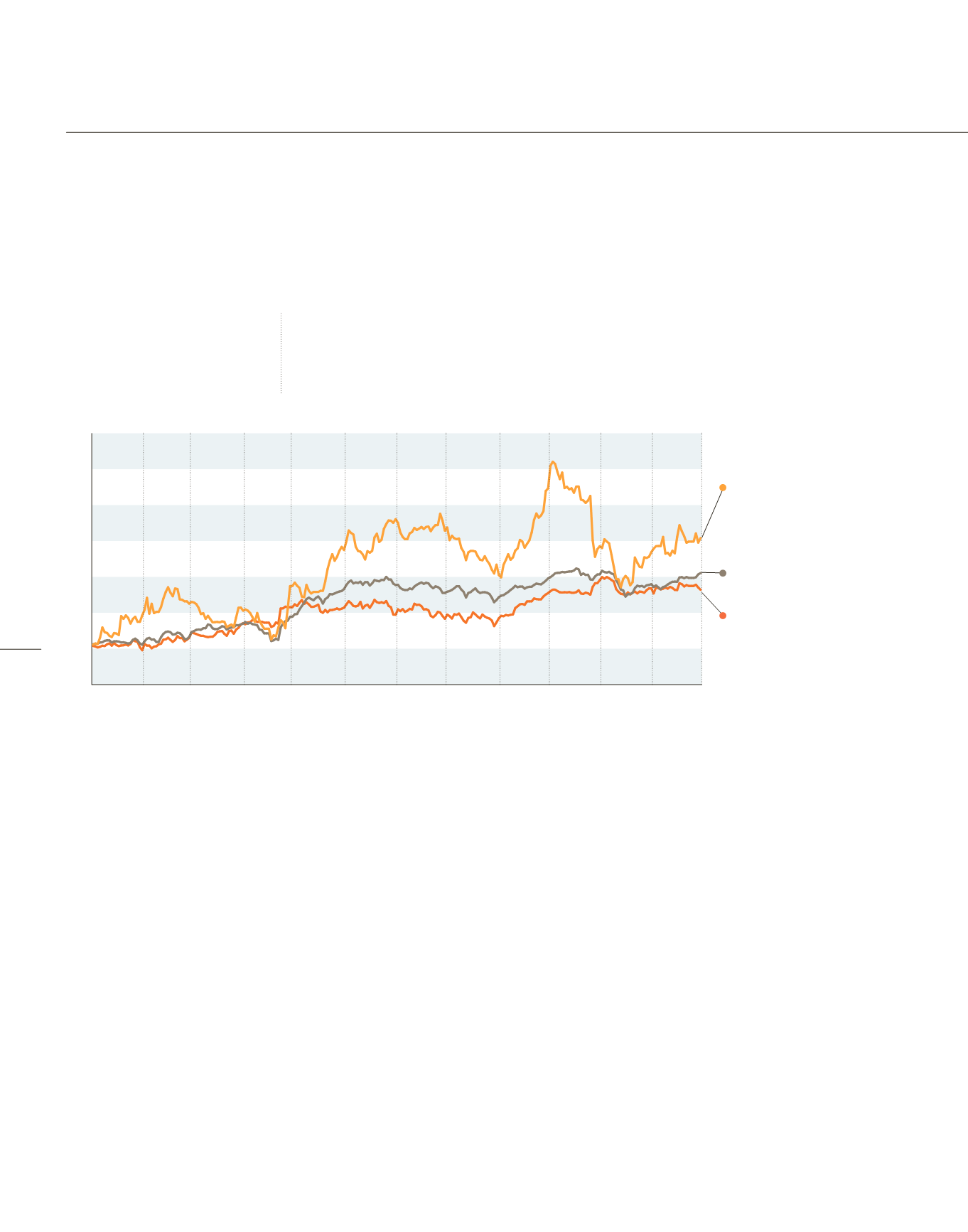

The LISI share continues its history of growth with a further increase

of more than 30% in one year. This good performance reflects good

earnings in line with expectations. This growth compares favorably

with major indices such as CAC SMALL (+21.1%) and ESTX InduGd&Ser

(+16.4%).

The end-of-year price (EUR 40.10) is close to the price range for the

year between the highest at EUR 47.60 on October 4

th

and the lowest

at EUR 30.70 on January 2

nd

.

In terms of volume, 7,418,339 shares were traded, a sharp increase

compared to 2016 and 2015, and an improvement in capital exchanged

(+234%) due to share price developments. In total over the year, 43%

of the float was traded.

Coverage of the stock

The stock is followed by 9 stockbrokers who regularly issue research

notes accompanied by opinions and objectives corresponding to the

assessment by the analyst responsible. This cover makes it possible

to obtain full and diverse information for professional or private

investors.

The LISI Group takes part in a large number of conferences, roadshows

and investor meetings for the cities of Geneva, London, Lyon,

New York, Paris, and Zurich. In total, the management of LISI met

with more than 250 investors during the 2017 financial year.

The communication policy is based on complete and transparent

communication, a presentation of the results along with the

semi-annual and annual publications and on the assessment of the

forecasts by the panel of analysts based on their macro-economic

assumptions.

+30.8%

LISI

+16.4%

ESTX InduGd&Ser

+21.1%

CAC Small Index

90

100

110

120

130

140

150

160

DEC.

NOV.

OCT.

SEPT.

AUGUST

JULY

JUNE

MAY

APRIL

MARCH

FEB.

JAN.

74

SHAREHOLDER GUIDE

+30.8%

ANOTHER YEAR

OF STRONG GROWTH

LISI’S PROGRESS OVER 2017:

EUR 40.10

PER SHARE

STOCK MARKET DATA