66 I

LISI 2016 ANNUAL REPORT

T

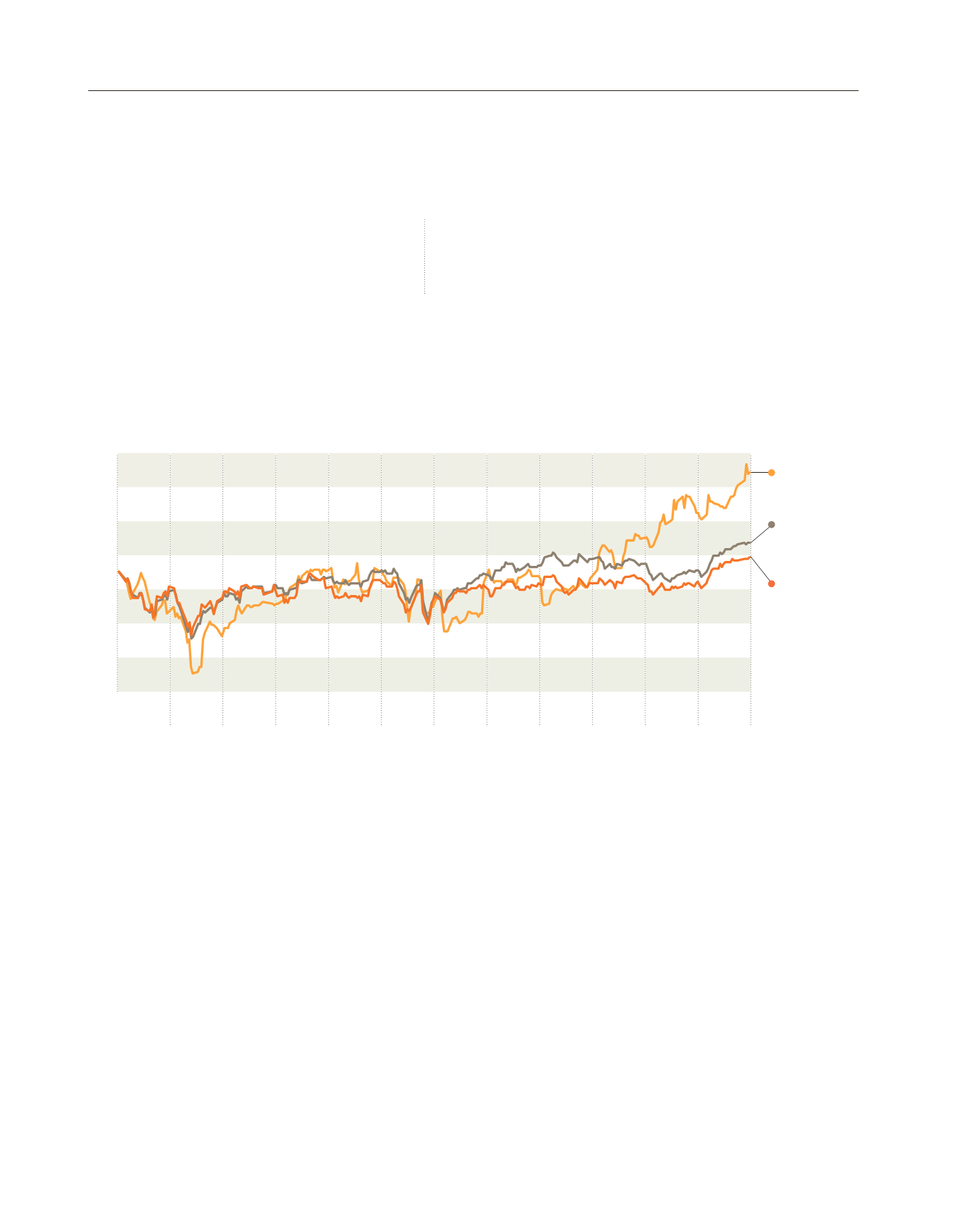

heLISIsharehasbeencontinuing

to rise for 3 consecutive financial

years with an acceleration since

July 2016, benefiting fully from

good performance results

across its 3 markets: aerospace, automobile

and medical. This growth compares favorably

with the main indices such as CACMID 60

(+ 6.7%) and Euronext 100 (+ 3.0%).

The end of year price is close to the annual

highs for the year (€31.20) and some distance

from the record low of €19 reached on

February 12, 2016.

In terms of volume, 3,389,092 shares were

traded, a fall compared to 2015, but figures

have been rising sharply since September

2016. The average volume traded over the last

quarter is nearly 28,000 shares a day, i.e. 18%

of the floating volumes traded (23% in 2015).

Coverage of the stock

The title is followed by 9 Stock Exchanges

which regularly publish research notes

accompanied by opinions and targets

corresponding to the assessment of the

analyst in charge. This cover makes it

possible to obtain full and diverse information

for professional or private investors.

The LISI Group takes part in a large number

of conferences, roadshows and investor

Stock market data

32

30

28

26

24

22

20

18

DEC.

2015 JAN.

FEB. MARCH APRIL

MAY JUNE JULY AUG.

SEPT.

OCT.

NOV.

DEC.

+ 22.8%

LISI

+ 6.7%

CACMID60

+ 3.0%

EURONEXT 100

meetings in the cities of London, Lyon,

New York and Paris. All in all, the LISI

management met with nearly 200 investors

during the 2016 financial year.

The communication policy is based on full

and transparent communication, with a

presentation of half-yearly and yearly results

as soon as published and on the appreciation

of forecasts by the analysts agency based

on its macroeconomic assumptions, without

the LISI Group being held to making any

numbered commitments (guidance).

+22.8

%

Another year of strong growth

for the LISI’s share over 2016

€

30.65

per share