80

LISI 2015

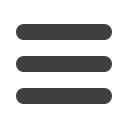

FINANCIAL DATA

INCOME STATEMENT

(in €'000)

12/31/2015

12/31/2014

restated*

Pre-tax sales

1,458,052 1,306,530

Changes in stock, finished products

and production in progress

20,405

1,682

Total production

1,478,457 1,308,213

Other revenues

(a)

13,083

17,440

Total operating revenues

1,491,540 1,325,653

Consumed goods

(398,213)

(344,613)

Other purchases and external expenses

(308,415)

(265,077)

Value added

784,912 715,963

Taxes and duties

(b)

(11,590)

(9,357)

Personnel expenses

(including temporary employees)

(c)

(569,236)

(513,273)

EBITDA

204,086 193,333

Depreciation

(73,787)

(64,630)

Net provisions

16,194

3,097

EBIT

146,493 131,800

Non-recurring operating expenses

(11,148)

(10,852)

Non-recurring operating revenues

5,308

8,058

Operating profit

140,652 129,005

Financing expenses and revenue

on cash

(6,163)

(6,410)

Revenue on cash

983

807

Financing expenses

(7,146)

(7,217)

Other interest revenue

and expenses

(9,819)

1,563

Other financial items

35,466

28,285

Other interest expenses

(45,285)

(26,722)

Taxes including CVAE (Tax on

Companies’ Added Value)

(b)

(42,741)

(42,631)

Share of net income of companies

accounted for by the equity method

(71)

31

Profit (loss) for the period

81,859 81,557

Attributable as company shareholders’

equity

81,764

81,464

Interest not granting control over

the company

95

93

Earnings per share (in €)

1.55

1.55

Diluted earnings per share

(in €)

1.55

1.55

* 2014 financial statements restated to account for IFRIC 21.

(a) In order to provide readers of the financial statements with better information that

is in accordance with international standards, in the 2015 financial statements the

Company has continued classifying revenues related to CIR (Research Tax Credit) as

“Other Revenues”.

(b) As at December 31, 2015, in accordance with the CNC (French National Accounting

Committee) notice of January 14, 2010, the amount of CVAE (Tax on Companies’ Added

Value) was classified as “Corporate Taxes” (on profits) in the sum of -€7.2 million.

(c) As at December 31, 2015 the competitiveness and employment tax (CICE) was

provisioned for an estimated €9.5 million.

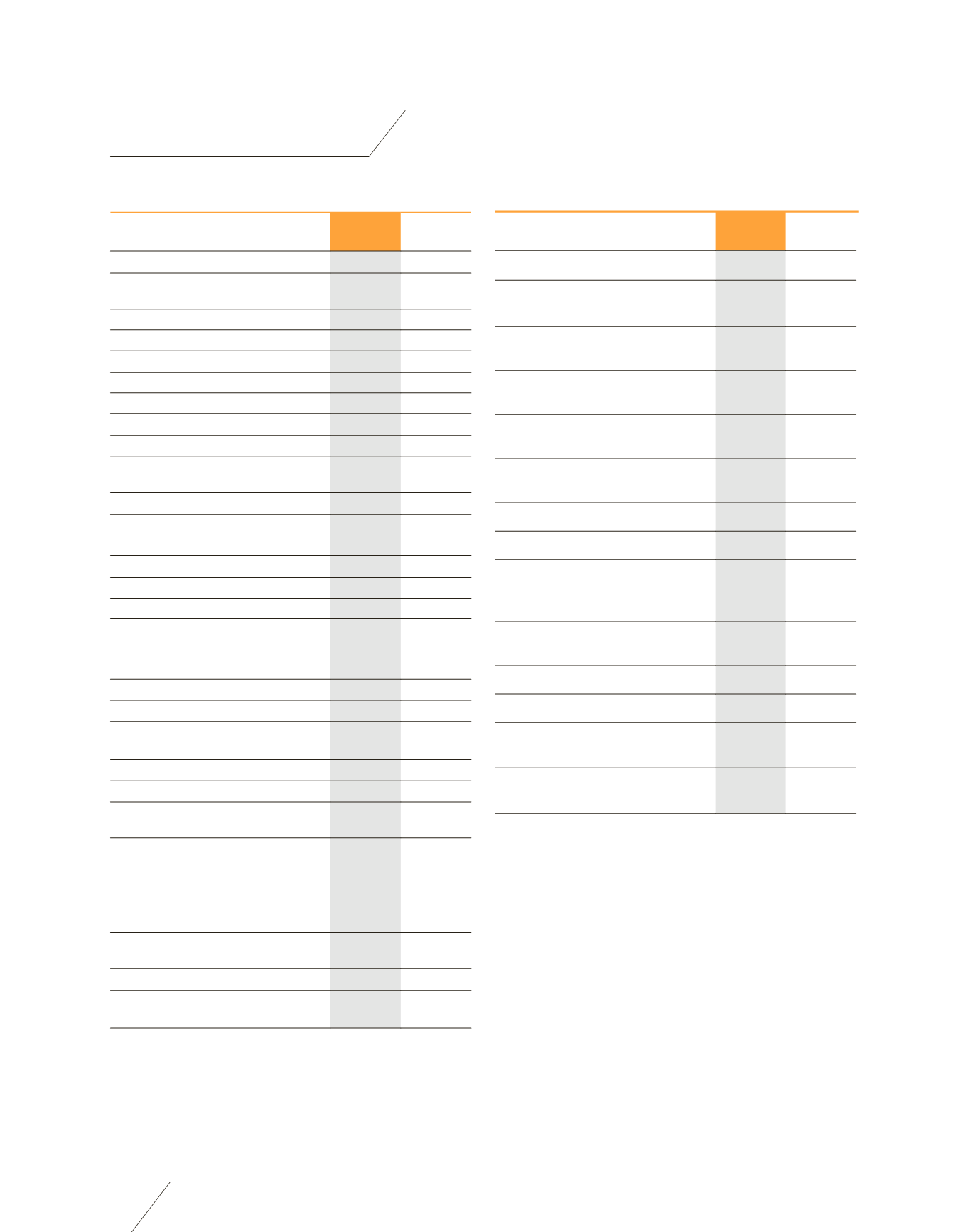

STATEMENT OF OVERALL EARNINGS

(in €'000)

12/31/2015

12/31/2014

restated*

Profit (loss) for the period

81,859 81,557

Other items of overall income

applied to shareholders equity

Actuarial gains and losses out of

employee benefits (gross element)

6,192

(8,115)

Actuarial gains and losses out of

employee benefits (tax impact)

(2,118)

2,930

Restatements of treasury shares

(gross element)

156

(1)

Restatements of treasury shares

(tax impact)

(56)

0

Payment in shares (gross element)

2,951

1,227

Payment in shares (tax impact)

(1,065)

(443)

Other items of overall income

that will cause a reclassification

of income

Exchange rate spreads resulting from

foreign business

19,351

23,341

Hedging instruments (gross element)

(2,189)

1,535

Hedging instruments (tax impact)

(18)

(554)

Other portions of global

earnings, after taxes

23,202 19,919

Total overall income

for the period

105,061 101,476