79

LISI 2015

List of brokers

Agnès BLAZY

Laurent GELEBART

Christophe MENARD

ID MIDCAPS

Denis SCHERRER

Jean-François GRANJON

Chloé LEMARIE

Antoine BOIVIN-CHAMPEAUX

Christophe QUARANTE

Stock Identification Sheet

ISIN Code:

FR 0000050353

Reuters code:

GFII.PABloomberg code:

FII.FPCompartment:

A Eurolist

Stock marketplace:

Euronext Paris

Number of shares:

54,023,875

Market capitalization as at

December 31, 2015:

€ 1,348 m

Indices

: CAC

®

AERO&DEF. , CAC

®

-All Shares ,

CAC

®

-All tradable, CAC

®

Industrials, CAC

®

Mid & Small,

and CAC

®

Small

2016 events

The AGM will be held on April 27, 2016 on company

premises: Immeuble Central Seine – 46 – 50 Quai de

la Rapée 75012 PARIS.

The dividend payment will be made on May 9, 2016.

The release of the sales for the 2

nd

quarter of 2016,

as well as those for the half-yearly accounts

will be available on line via the LISI website

(www.lisi-group.com), on July 28, 2016.

The financial information for the 3

rd

quarter of 2016

will be available on line via the Group website on

October 26, 2016 after the close of the market.

Securities accessible to individual

shareholders

The Group’s objective is to develop the individual

shareholdings in 2016, and, in this regard, the group

is communicating much more, participating in trade

fairs and participating in presentations to investment

clubs and to individuals.

Contacts

For any information or documentation:

LISI S.A Financial Department

Tel: +33 (0)3 84 57 00 77

Fax: +33 (0)3 84 57 02 00

Email:

emmanuel.viellard@lisi-group.comShareholders, investors, financial analysts and

financial and economic press please contact:

Mr. Emmanuel Viellard – CEO

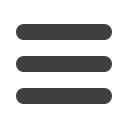

Breakdown of capital

54.9%

CID*

2.3%

Own shares**

5.1%

FFP Invest

5.7%

VMC

32%

Free float (including

employee savings

plans for 1.3%)

* Including direct and indirect holdings:

VMC: 20.94%

FFP Invest: 18.94%

CIKO: 16.65%

** Reserved for performance share plans