44

LISI 2016 FINANCIAL REPORT

■■

Ankit Fasteners Pvt, Ltd, previously consolidated by the equity

accounting method, was consolidated by the full consolidation

method as of January 1, 2016, after the LISI Group took a majority

interest.

■■

On August 1, 2016 the LISI Group sold to the DAHER Group all

the tangible and intangible assets in the “Floor covering – Interior

Design” activity belonging to its subsidiary INDRAERO SIREN. The

assets concerned are not significant to the Group’s indicators.

2.3.4

I

Acquisitions of subsidiaries

In application of standard IFRS 3 on business combinations, the

LISI Group has 12 months from the acquisition date to make a

final allocation of the acquisition price and a final calculation of the

goodwill. Consequently, the amounts recognized at December 31,

2016 in the acquisition of LISI MEDICAL Remmele may be reviewed

at subsequent closures.

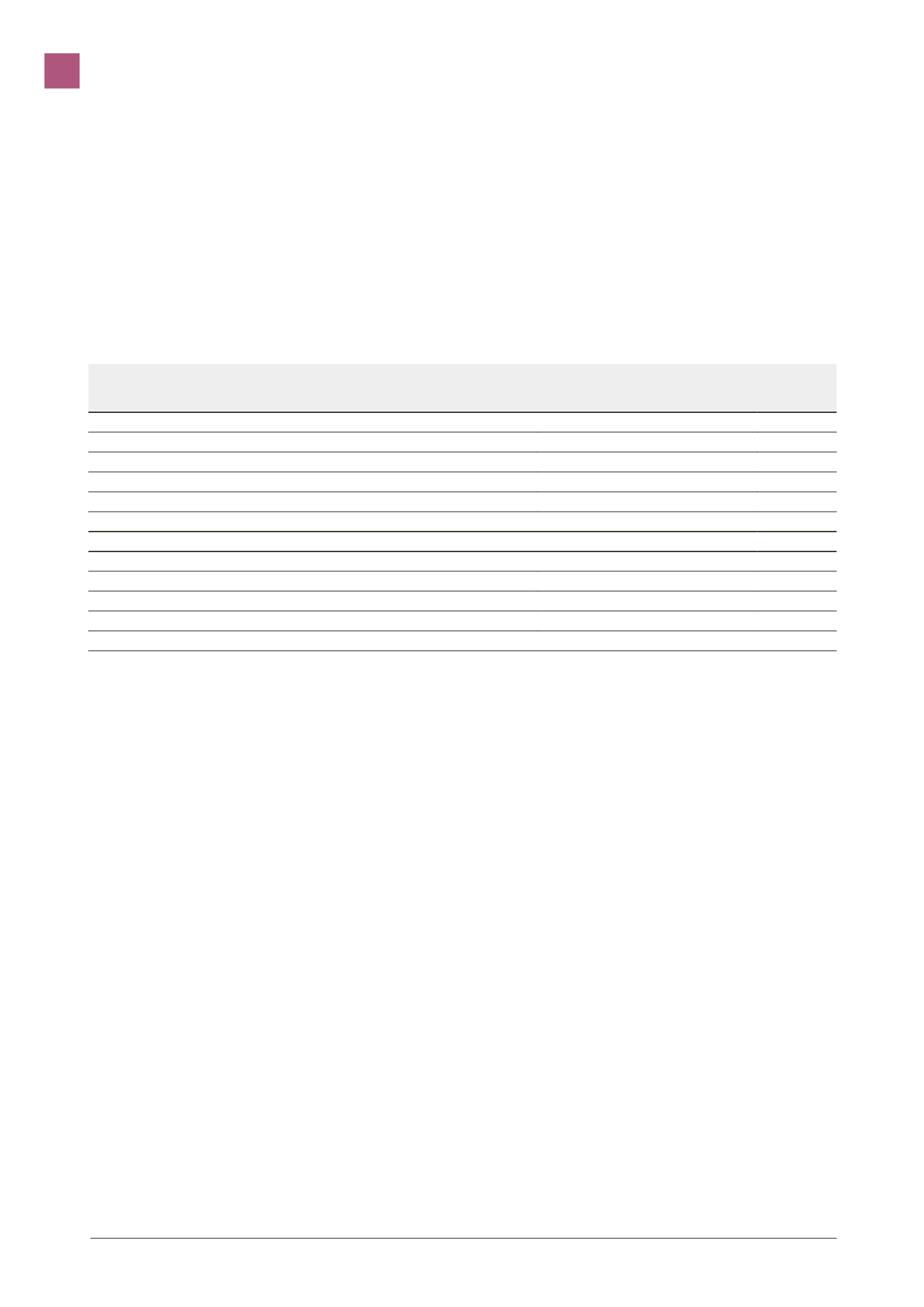

Details of the impact of this acquisition on the Group consolidated balance sheet are given below:

(in €’000)

Recognized fair value

on the acquisition date

Notes

Fixed assets

42,266

2.7.2

Other net short-term assets and liabilities

2,786

Net inventories

8,998

2.7.2.1

Net debt

(3,850)

Taxes and provisions

(380)

Cash and cash equivalents

0

TOTAL NET SITUATION OF THE INCOMING COMPANY

49,820

% of the assets recovered

100

Share of the minorities

Share of the net situation acquired by Hi Shear Corp

49,820

Acquisition price

93,410

Goodwill

43,590

2.4

I

FINANCIAL RISK MANAGEMENT

The Group is exposed to the main following risks arising from the use

of financial instruments:

–

–

credit risk;

–

–

liquidity risk;

–

–

market risk,

–

–

interest rate risk;

–

–

currency risk;

–

–

raw materials risk.

This note presents the information on the Group’s exposure to each

of the risks above, its objectives, policy and procedures for measuring

and managing risk, and for capital management. Quantitative

information is given in other sections of the consolidated financial

statements.

The aim of the Group’s risk management policy is to identify and

analyze the risks to which it is exposed, define the upper and lower

risk limits and the controls required to manage risk and ensure

compliance with the limits defined.

2.4.1

I

Credit risk

Credit risk is the Group’s risk of financial loss in the event that a

customer or other party in a financial instrument fails to meet their

contractual obligations. This risk derives mainly from trade receivables

and securities held for sale.

Trade and other receivables

Group exposure to credit risk ismainly influenced by individual customer

profiles. The Group has a policy of monitoring trade receivables, allowing

it to constantly control its third party risk exposure. The Group believes

that the credit risk of write-off of past due receivables is minimal.

At December 31, 2016 the amount of provisions for doubtful debts

amounted to €3.7 million, to be compared to total receivables of

€226.3 million. The amount of the permanent losses recognized over

the year was €0.3 million.

Risk on investment securities

On December 31, 2016, the Group’s balance sheet showed cash

and cash equivalents of €141.7 million (see §2.6.2.3 Cash and cash

equivalents). The cash equivalents are mainly made of marketable

securities represented by monetary mutual funds, invested in very short

maturity securities and representing no risk in capital, in accordance

with the Group’s cash management policy. In accordance with

accounting principles, these investments are valued at their market

price at year-end.

2.4.2

I

Liquidity risk

The Group’s cash management is centralized: the vast majority of

the cash surpluses or financing requirements of its subsidiaries,

where local legislation permits, is invested or financed by the parent

company on normal market terms. The central cash management

team manages the financing of the Group, current and forecast, and

ensures its capacity to meet its financial commitments. For that

CONSOLIDATED FINANCIAL STATEMENTS

3