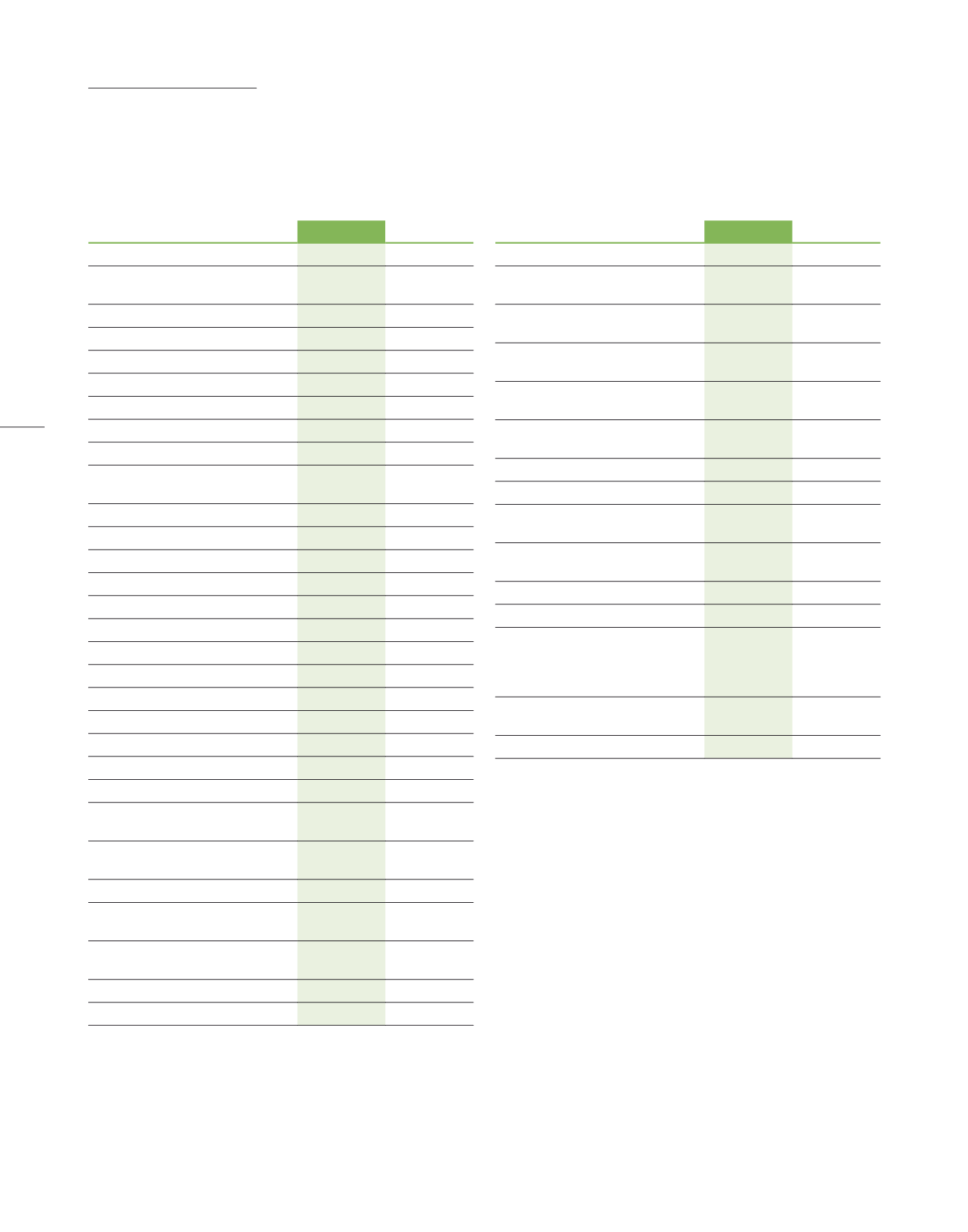

(in€'000)

12/31/2014

12/31/2013

Pre-taxsales

1,306,530

1,148,971

Changes instock, finishedproductsand

production inprogress

1,682

12,474

Totalproduction

1,308,213

1,161,445

Other revenues*

17,440

14,016

Totaloperatingrevenues

1,325,653

1,175,461

Consumedgoods

(344,613)

(310,892)

Otherpurchasesandexternal expenses

(265,077)

(219,416)

Valueadded

715,963

645,154

Taxesandduties**

(9,479)

(8,614)

Personnel expenses (including

temporaryemployees)***

(513,273)

(457,657)

EBITDA

193,211

178,883

Depreciation

(64,630)

(57,450)

Netprovisions

3,097

7,456

EBIT

131,678

128,889

Non-recurringoperatingexpenses

(10,852)

(16,393)

Non-recurringoperating revenues

8,058

2,639

Operatingprofit

128,883

115,134

Financingexpensesandrevenueoncash

(6,410)

(1,310)

Revenueoncash

807

1,948

Financingexpenses

(7,217)

(3,258)

Other interestrevenueandexpenses

1,563

(2,504)

Other financial items

28,285

12,676

Other interestexpenses

(26,722)

(15,180)

Taxes (ofwhichCVAE (Taxon

Companies’AddedValue)**

(42,587)

(36,779)

Shareofnet incomeof companies

accounted forby theequitymethod

31

Profit (loss)fortheperiod

81,479

74,540

attributableascompanyshareholders’

equity

81,386

74,639

Interestnotgrantingcontrolover the

company

93

(99)

Earningspershare (in€)****:

1.55

1.42

Dilutedearningspershare (in€)**** :

1.55

1.42

* Inorder toprovide readers of the financial statementswithbetter information that is in

accordancewith international standards, in the 2014 financial statements the Company

hascontinuedclassifyingrevenuesrelatedtoCIR(ResearchTaxCredit)as“OtherRevenues”.

**As at December 31, 2014, in accordancewith the CNC (National AccountingCommittee)

notice of January 14, 2010, the amount of CVAE (Tax on Companies’ Added Value) was

classifiedas “CorporateTaxes” (onprofits) inthesumof-€6.0M.

***The “CICE” (Tax credit for competitiveness and employment) has been presented in

applicationof the IFRSstandardsasadeduction fromtheemployment-relatedexpenses for

anamountof€8.6M.

****Stocksplitby5oftheLISIshareonSeptember12,2014 .

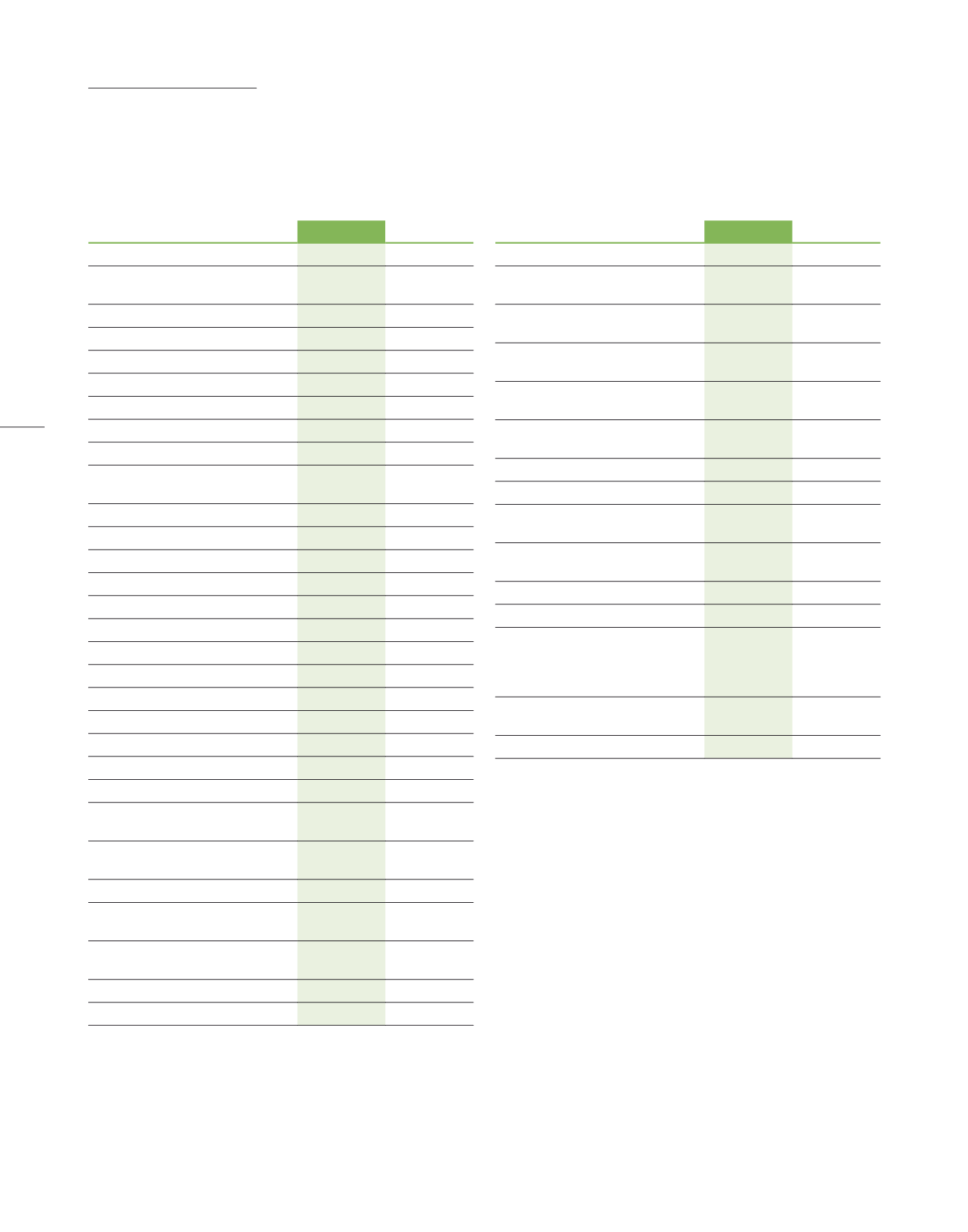

(in€'000)

12/31/2014

12/31/2013

Profit (loss)fortheperiod

81,479

74,540

Other itemsofoverall incomeappliedto

shareholdersequity

Actuarialgainsand lossesoutof

employeebenefits (grosselement)

(8,115)

2,718

Actuarialgainsand lossesoutof

employeebenefits (tax impact)

2,930

(609)

Restatementsof treasuryshares (gross

element)

(1)

388

Restatementsof treasuryshares (tax

impact)

0

(140)

Payment inshares (grosselement)

1,227

2,248

Payment inshares (tax impact)

(443)

(812)

Other itemsofoverall incomethatwill

causeareclassificationof income

Exchange ratespreads resulting from

foreignbusiness

23,341

(9,702)

Hedging instruments (grosselement)

1,535

(2,974)

Hedging instruments (tax impact)

(554)

253

Impactofacorrection indeferred

taxation forpreviousperiodsonshare

basedpaymentsand restatementof

treasurystock

(558)

Otherportionsofglobalearnings,

aftertaxes

19,919

(9,187)

Totaloverall incomefortheperiod

101,398

65,353

STATEMENTOFOVERALL

EARNINGS

INCOME STATEMENT

LISI 2014

72

STOCKMARKETDATA