LISI FINANCIALREPORT2013

21

FINANCIALSITUATION

2

For 3 consecutive financial years, return on capital employed (ROCE),

whichwas € 776m (as against € 738.3m in 2012) continued its rise, now

reaching19.1% (asagainst15.5% in2012).

OUTLOOK

TheLISIGroup'smain target for2014 is tocompensate foraslowdown in

growth in theLISIAEROSPACEdivisionwithastrongercontribution from

the other divisions. From this point of view, it shouldbeborne inmind

thattheexpectedresultsofthecostsreductionundertaken in2013 inthe

LISIAUTOMOTIVEdivisionwillonlymaterialize from theendof the2014

financial year.TheLISIMEDICALdivision isdisplayingagreaterpotential

for improvement, though on a more modest scale when compared

with the entire consolidatedgroup. So 2014 is expected tobe a year of

consolidationof theprogressmade in2013, in termsbothof the level of

activityandof income.

The LEAP plan (LISI Excellence Achievement Program) will play its

full role as an across the board tool for improving the entire Group's

competitiveness, with the aim of achieving maturity for the systems

deployedanda largeproportionofthestafftrained.

The investment program will remain at the same levels as in 2013,

especially on account ofmajor projects under way tomeet the strong

demand for new products in both the aerospace and automotive

divisions.

To support this long-term development strategy the LISI Group can

base itselfonaparticularly solid financial situation,whichbecameeven

strongerduring2013: ithasthereforeundertakenaUSPrivatePlacement

(USPP) for $75m and has obtained a €30m loan from the European

InvestmentBank (EIB), intended to finance itsResearch&Development

costs. Itwill allow theGroup tograspgrowthopportunities thatpresent

themselves.

2.2

|

LISI AEROSPACE

n

Excellentresistanceoftheworldaerospacemarket.

n

Improvementofall financialperformance indicators.

n

Sharprise in investmentsrelatedtoconsolidatingoperationsandtothe

launchofnewproducts.

n

Apause ingrowthexpected in2014.

Market

International air passenger trafficwas up4.5% as comparedwith 2012,

andhasconfirmeditsaverageannualgrowthrateof5.4%

1

over3financial

years.Freighttrafficwasalsoup1.0%

1

in2013after2yearsofdecline.

Boeing and Airbus posted similar developments, with 648 deliveries

for Boeing as against 626 for Airbus, and 1,355 net orders for Boeing

and 1,503 forAirbus. Theorderbookexceeds 10,600aircraft for the two

manufacturers,an8-yearrecord formostprograms.

On the other hand, the regional aircraft markets for business planes

and helicopters have not displayed the same dynamism. Themilitary

applications segment has suffered drastic reductions in the Defense

budgets inbothEuropeandtheUSA.

Activity

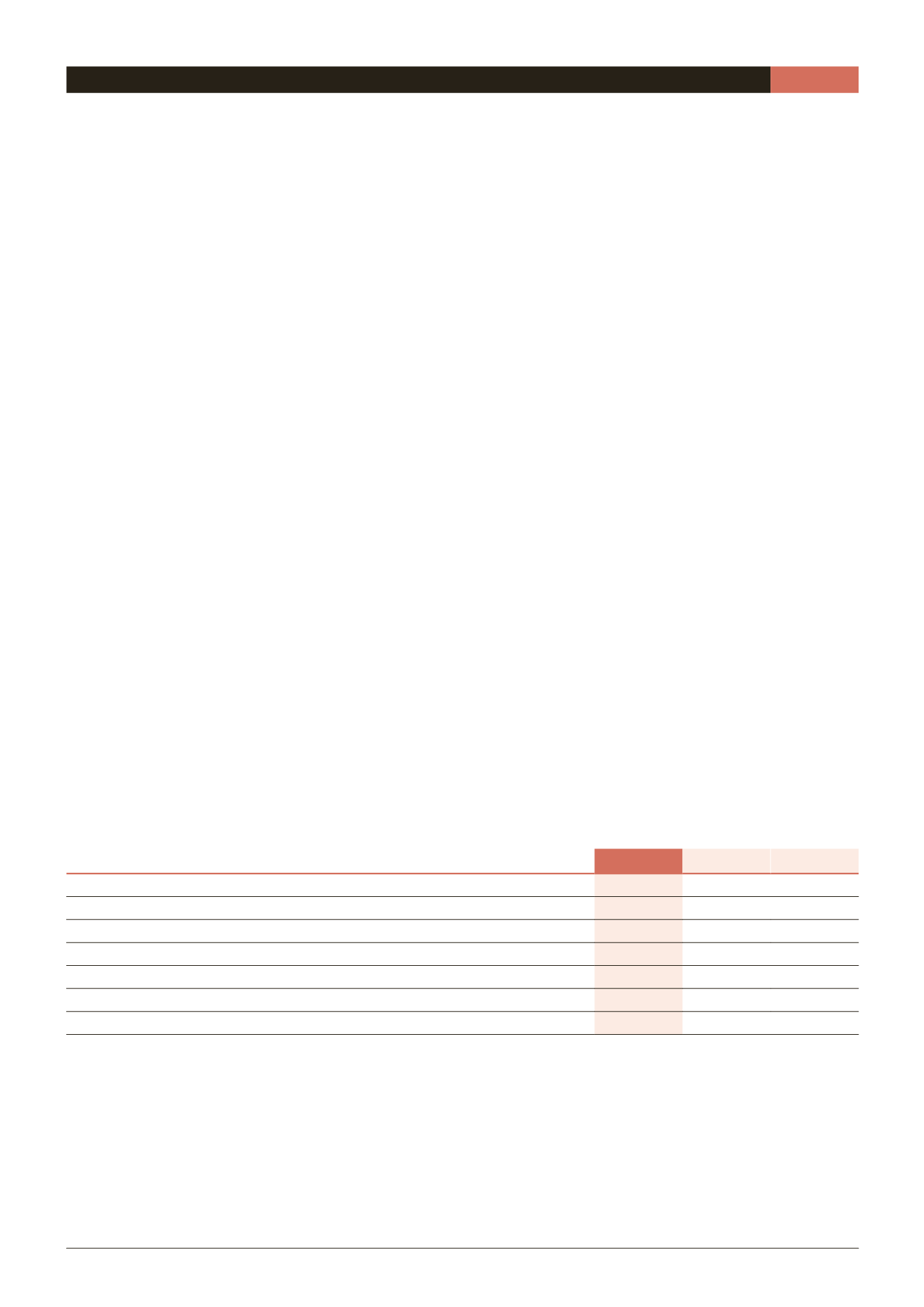

In€m

2013

2012

Changes

Sales revenue

663.9

591.7

+12.2%

EBIT

118.2

91.3

+29.6%

Operatingcash flow

107.5

87.6

+22.8%

NetCAPEX

-52.3

-38.5

+35.9%

FreeCashFlow

2

32.6

38.8

-16.0%

Registeredemployeesatperiodend

5,604

5,205

+7.7%

Full timeequivalentheadcount

3

5,951

5,456

+9.1%

1Source : IATA

2FreeCashFlow:operatingcash flowminusnet industrialCAPEXandchanges inworkingcapital requirements.

3 Includingtemporaryemployees.