20

I LISI FINANCIALREPORT2013

FINANCIALSITUATION

2

n

Inorder toensureandachieve thisgoal, LISI hasadoptedHSE (Health

Safety Environment) policy andorganization to identify key areas for

improvement,prioritizegoals, andderive theappropriateactions.This

policy and organization are based on the international OHSAS 18001

standard (international standardgoverning themanagement system

ofhealthandsafetyatwork).

n

At the end of 2013, the rate of work accidents causing stoppages

involvinganemployee (TF0)slightly improvedto10.4permillionhours

worked, an improvement of 2% on 2012. The rate of work accidents

withandwithout stoppages (TF1)was 16.3, aslight improvementof 1%

ascomparedwith2012.

Environmentalinformation(Art.R225-105)

n

For several years, the LISI Group was fully engaged in placing

environmental issues at the heart of its corporate culture in order to

turnthem into intrinsicvalues.

n

Thepolicyandorganizationput inplacearebasedonthe international

standardISO14001(internationalstandardgoverningthemanagement

systemoftheenvironment).

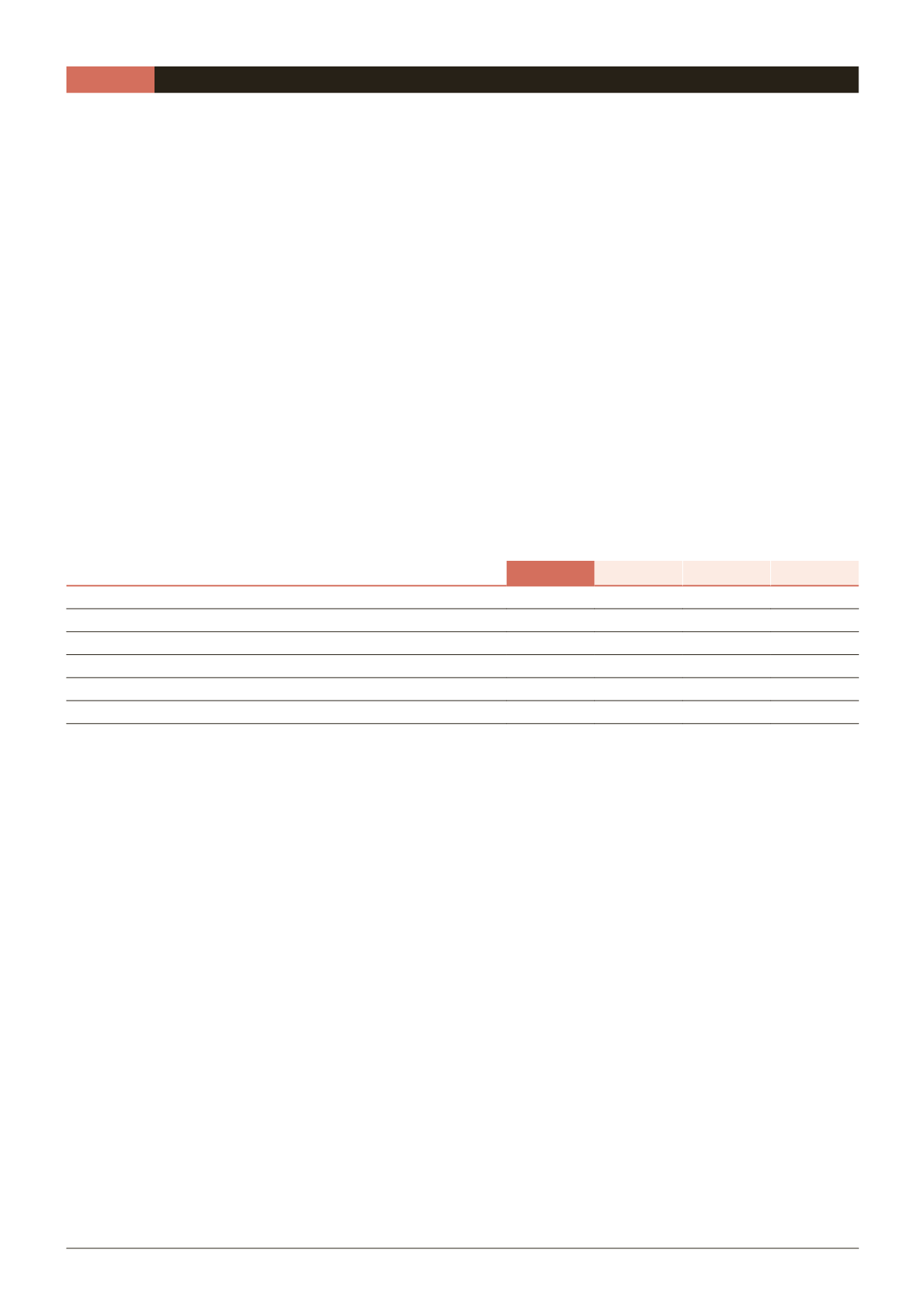

Headcount

n

At December 31, 2013, the Group employed 9,239 employees, an

increase of the total workforce of 330 people, which represents an

improvementof+3.7%comparedto2012.

n

This increaseofthetotalheadcount isdueontheonehand, toastrong

increase intheworkforceofLISIAEROSPACE(399moreemployeesthan

in2012 representingan increaseof 7.7%) andon theotherhand, toan

adjustment of thehead countwithin LISI AUTOMOTIVE (-70persons /

-2.2%).TheworkforceofLISIMEDICALremainsstable.

2013

2012

Difference

as a%

LISIAEROSPACE

5,604

5,205

+399

+7.7%

LISIAUTOMOTIVE

3,143

3,213

-70

-2.2%

LISIMEDICAL

474

475

-1

-0.2%

LISISA

18

16

+2

+12.5%

TOTAL

9,239

8,909

+330

+3.7%

Temporaryemployees

546

563

-17

- 3.0%

2013financialresults

LISI AEROSPACE is themain contributor to the Group's income, in line

with the previous year. The LISI AUTOMOTIVE division was up due to

reorganizationstepstakenin2012.TheLISIMEDICALdivisionstillremains

marginal insizeand itsresultsaredown.

Nevertheless, all the management indicators are up. Gross operating

profit was up 15.6% to €178.9m, which is 15.6% of sales revenues. It

includes income of €4.7m under "Employment Competitiveness Tax

Credit"(CICE). EBIThada larger increaseat€128.9m(up28.4%,asagainst

€100.4m in2012).SoduetotheexcellentperformanceofLISIAEROSPACE,

which isupagain, EBITpassedanewmilestoneand reachedalmost 2.0

points year onyear. At 11.2% theGroup'soperatingmarginexceeded its

nominal targetof10%.

Non-current expenses were fairly high for the 2013 financial year and

reflecttheconsequencesofthedifficultandpossibly long-termsituation

in the European automobilemarket. At the same time, the Group has

alsomadeprovision in the LISI AEROSPACEdivision for a total of €5.5m,

foramortizationof intangibleassetsand reorganizationmeasures in the

Racingsector intheUSA.

Non-operating revenues aremade up on the one hand of the cost of

financingof€ -3.3m,which remained stableby comparison to2012, and

on the other hand, the effect of foreign exchange fluctuations, which

generateda loss fornon-operating income inthis financialyearof€1.7m.

Thetaxcharge,calculatedonthebasisofcorporate incometaxappliedto

netpre-tax incomereflectsaneffectiveaveragetaxrateof33.2%,slightly

downascomparedwith2012 (35.7%).

At€74.6m,net incomewasthusup30.3%ascomparedwith2012.

Earningspersharewere€7.12asagainst€5.47 in2012.

Thefinancialstructurehasbeenstrengthenedafteramajor

investmenteffort

Consolidatedworking capital requirements remained virtually stable in

absolute terms, and improved slightly in relative terms to less than 79

days.With cash flow at a good level at €142.3m, investments couldbe

easilyhandledwhilemaintainingapositivenetFreeCashFlowof€28.5m,

ascomparedwith€38.5m in2012.

TheGrouphasaccordinglybeenabletocontinuetoreduceitsborrowings:

at €67.8m (as against €76.7m at the end of 2012), net borrowings to

shareholders' equity ("gearing ") didnot exceed 10.8%, as against 13.3%

thepreviousyear. Its financialstructure isthereforeparticularlystrong.